At the end of November we looked at the regional bank etf KRE and detailed a position that looked for a small move higher into year end followed by a breakout into the New Year. …

Continue readingI am here to tell you from recent experience that despite very low levels of implied volatility, it has still been very painful of late to be long cheap as dirt puts in the hope …

Continue readingOne of the most frustrating feelings in options trading is getting the direction right but having on the wrong trade to take advantage of the move. This is unique to options. The feeling of missing …

Continue readingIBM will report their Q4 results Wednesday, January 17th after the close. The options market is implying about a 3.5% move between now and next Friday’s close, or about 3% one day move following results, …

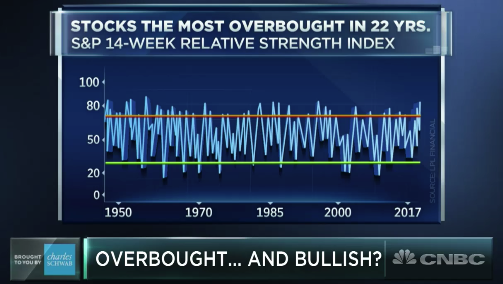

Continue readingStocks in the U.S. seemingly make new highs daily. The S&P 500 (SPX) is already up 3.35% on the year, I suspect one of the best starts to a year in a while. Headlines in …

Continue readingI often get asked the importance, or my reliance on technical analysis when it comes to investing / trading. My answer has been fairly consistent for nearly two decades, charts serve as an input to …

Continue readingYou may have heard on the news of security vulnerabilities nicknamed Meltdown and Spectre, that compromise passwords and encryption keys on a ton of products using Intel chips. INTC stock is down sharply as a …

Continue readingIf you have ever driven, or been driven in a Tesla car, you know that it is an exceptional piece of machinery. Of course the price of that machinery and the environmental benefits are hotly debated …

Continue readingOn Friday’s Options Action on CNBC, my co-panelist Carter Worth of Cornerstone Macro Research laid out the fairly poor relative strength of bank stocks to the broad market over the last couple years, click below …

Continue readingIn early December we checked in on Pepsi stock and detailed two different ways to position bearishly with defined risk. With the stock slightly higher than entry I wanted to check in on the trades, …

Continue reading