You may have heard on the news of security vulnerabilities nicknamed Meltdown and Spectre, that compromise passwords and encryption keys on a ton of products using Intel chips. INTC stock is down sharply as a result while some competitors’ stocks like AMD and NVDA seem to be benefiting.

Before all this news broke we took a look at INTC and detailed a defined risk, mildly bullish trade idea targeting the 47 area. At the time the stock was 44.60. Here was the idea, from December 15th:

Buy INTC ($44.60) Jan / Feb 47 Call Calendar for 50 cents

-Sell to open 1 Jan 47 call at 30 cents

-Buy to open 1 Feb 47 call for 80 cents

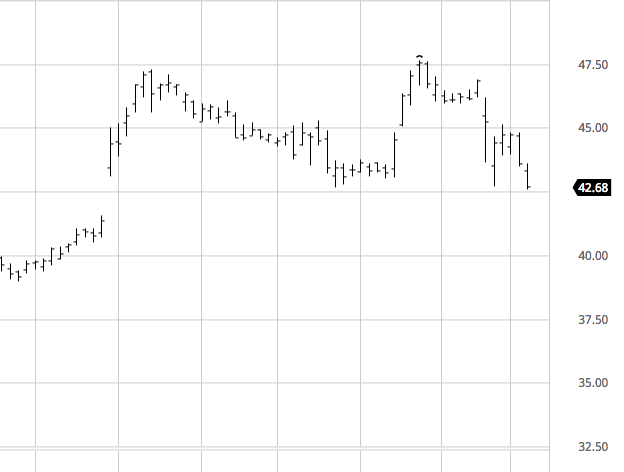

The stock immediately went higher and the trade was looking good, until the news broke or course. Now with the stock lower at about 42.60 this trade is worth about .23 versus the initial .50 at risk. And the stock is near a breakdown level:

The news cycle is unlikely to suddenly get better, and one main reason this isn’t worse for the trade idea is vol has popped, holding some value in the Feb calls. As far as trade management it likely makes sense to either bail now or on any bounce from this level. If the stock goes below support here it’s likely to gap fill quickly towards 41. A bounce could take it back towards 44/45 at which point it would be less than a loss so that’s the main debate on when to take a loss.

Since this was a calendar it’s done a bit better than a more directionally biased trade and benefited from a pop in implied volatility. But unless the news cycle were to suddenly shift, 47 looks pretty far away and so a tight leash is in order.