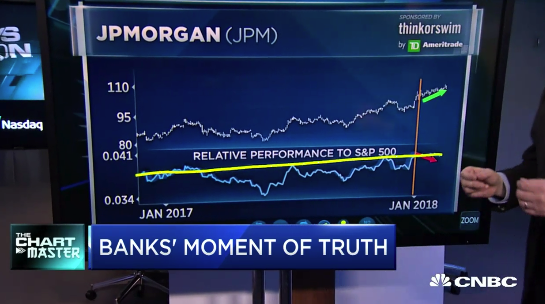

On Friday’s Options Action on CNBC, my co-panelist Carter Worth of Cornerstone Macro Research laid out the fairly poor relative strength of bank stocks to the broad market over the last couple years, click below to watch:

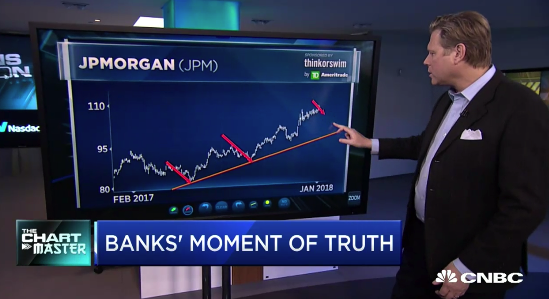

Carter specifically focused on JP Morgan (JPM) and its distance from its uptrend from the 2017 lows and the potential for near-term check back to trend:

Mike Khouw laid out a near-term, defined risk bearish trade structure to express this technical thesis. Mike’s trade idea was to buy the March 105/100 put spread for $1.15 vs the stock at $108.35. This trade breaks-even down at $103.85 and has a max profit potential of $3.85 down to $100. This trade risks about 1% of the stock price for profits of up to 3.5% of the stock price if the stock were down 8.35% on March expiration.

I like Carter’s technical take on the banking sector, and I like Mike’s trade direction, but I am not sure I am in love with such a tight out of the money put spread for nearly 3 months.

For instance, with the stock at $108.30 the March 105 / 95 put spread is offered at $1.65. This trade breakeven down at 103.35, only 50 cents below Mike’s $5 wide put spread but offers profit potential of up to $5 more, or a total of $8.35 if the stock were to checkback to the uptrend, which happens to intersect its October breakout level to new highs right near $95:

But making that bet against best of breed moneycenter bank like JPM is betting that you will get some stock specific news to drag the stock down or a broad market sell-off of at least 5% in the next couple months, which the sort has been elusive over the last year.

I’d rather bet against the sector using the XLF, the S&P Financial Select etf. In the very near term, with almost half the weight of this etf reporting next week, I would target a pullback to the recent breakout level of $27:

Short-term bearish trade idea:

XLF ($28.40) Buy Jan 19th 28 put for 13 cents

Breakeven down at 27.87, down 2% in the next week. While that does not sound like a lot, it would take most of the banks in the group moving in the same direction over the next week just to break-even. Not a high probability bet.

or

Intermediate-term bearish trade... If I were looking to play for some follow through into Feb/March, targeting the support in Oct & Nov I might consider:

XLF ($28.40) Buy March 28 / 26 put spread for 40 cents

-Buy 1 Mar 28 put for 57 cents

-Sell 1 Mar 26 put at 17 cents

Breakeven on March expiration:

Profits of up to 1.60 between 27.60 and 26 with max profit below 26

Losses of up to 40 cents between 27.60 and 28

or

Long-term bearish trade idea: If I were inclined to catch two earnings cycle and the lows made this past September, I might consider looking out to June expiration:

XLF ($28.40) Buy June 28 / 24 put spread for 80 cents

-Buy 1 June 28 put for $1

-Sell 1 June 24 put at 20 cents

Breakeven on June expiration:

Profits of up to 3.20 between 27.20 and 24 with max profit below 24

Losses of up to 80 cents between 27.20 and 28

My View: I am inclined to buy XLF put spreads in March or June as I cant put my finger on any one issue at the moment aside from a surprise earnings guide lower across the group that would cause bank stocks to trade lower despite a broad market decline.