In case you missed it, the two year chart of crude oil….. has been the inverse of the two year chart of the DXY, the US dollar index…. Yeah, I know you took your Econ back …

Continue readingUS

Event: The Home Depot (HD) reports Q3 results tomorrow before the opening. The options market is implying about a 3.5% one day move, which is rich to the 4 qtr avg move of about 2.6%. …

Continue readingHere is a quick recap of trades that we initiated, closed, or debated in the week that was Nov 9th to Nov 13th: Monday Nov 9th: Trade Idea – $XLU: Utility Playa *Trade: XLU ($42.25) Buy …

Continue readingEvent: Cisco Sytems (CSCO) reports fiscal Q1 results tonight after the close. The options market is implying about a 5.5% one day move tomorrow, which is rich to the 4 qtr average of about 4%, …

Continue readingFirst things first, a heartfelt shout out to all of those currently serving in the armed forces, all of those who have served and specifically to those close to us who have sacrificed in defense …

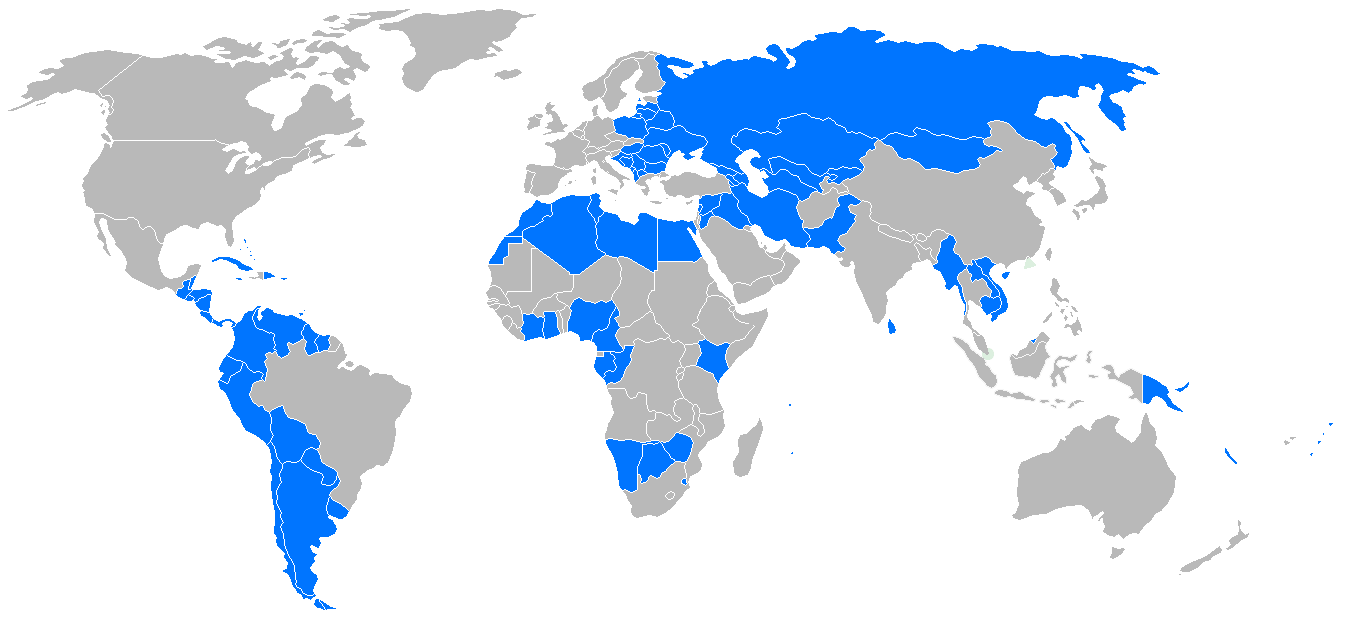

Continue readingIn today’s MorningWord (Bulls in China Shop) we looked at China’s bear market rally (since the Aug lows) and tried to determine what is says about the health of their economy, and what it means for global …

Continue readingI’m not that impressed with the recent bounce in the Shanghai Composite. Some have called it a new Bull Market (it has risen 20% from its August lows). Bu to me it feels like a …

Continue readingI want to highlight just two charts this morning. The first having to do with the question you hear a lot this time of the year. Will the S&P 500 (SPX) make new highs in 2015? …

Continue readingIn a great interview with the Financial Times, John Burbank of multi-strategy hedge fund Passport Capital this morning explains the reasoning behind his firms large wagers against commodities and emerging markets: Mr Burbank said years of QE had …

Continue readingThe VIX has been on a roller coaster the past few weeks, spiking as high as 50 on August 24th and then settling back near historical means with the slow creep higher in the SPX …

Continue reading