Today Alphabet (GOOGL) introduced their (kind of) much anticipated digital assistant, called Assistant to compete with Amazon’s (AMZN) Alexa/Echo products. The company also introduced a line of Google designed and branded smartphones that will compete …

Continue readingSPX

In this weekend’s Barron’s Striking Price column, long time columnist Steve Sears, (who I am a big fan of) had Steve Sosnick of Timber Hill fill in to discuss hedging ones portfolio into the Nov 8th …

Continue readingWe’re not getting to hear much policy discussion in this strange presidential election cycle but one topic that sometimes gets through is healthcare. A hot button issue over the past year on the Democratic presidential …

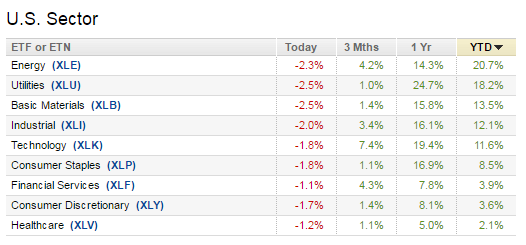

Continue readingHere are a few apparently directional options trades that caught my eye in today’s trading: XLK: There appeared to be an opening bullish bet in the S&P Technology Select etf when the etf was trading $47.70, …

Continue readingEvent: Pepsi (PEP) is scheduled to report its Q3 results Thursday morning prior to the open. The options market is implying about a 2%* one day post earnings move which is rich to the 4 …

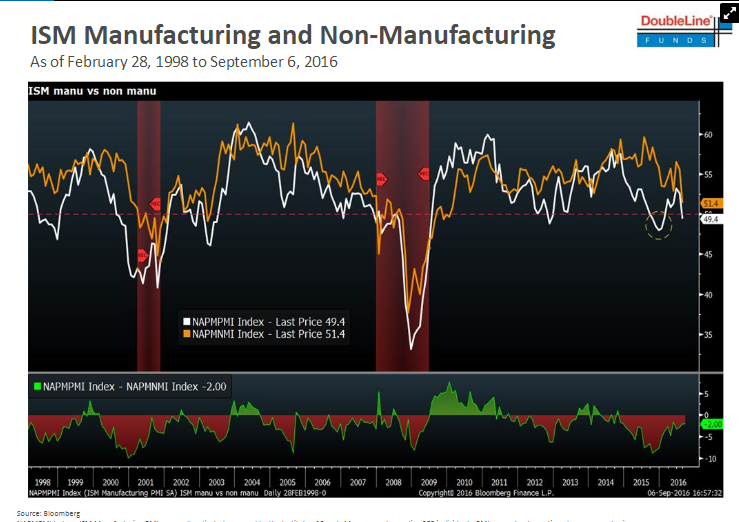

Continue readingOn CNBC’s Fast Money last night we had the pleasure of getting DoubleLine Capital’s Jeffrey Gundlach’s response to the Federal Reserve’s policy statement (or non-statement): On Friday, I detailed some of Gundlach’s recent commentary from …

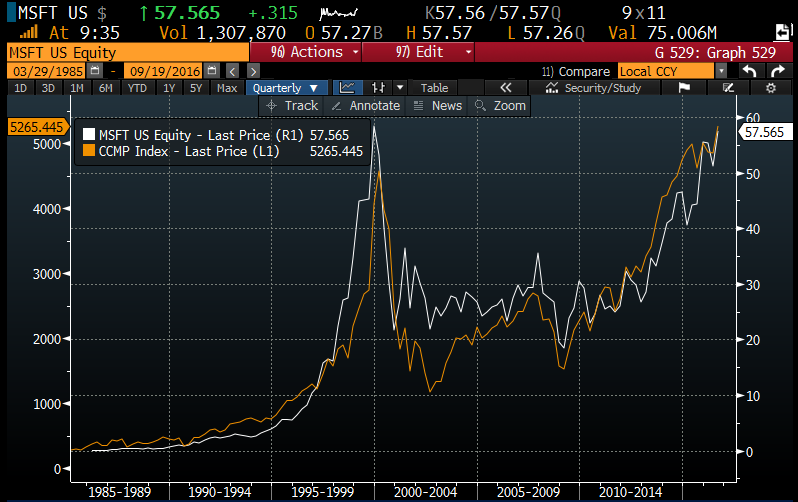

Continue readingLast night, Microsoft (MSFT) announced that they will be replacing their existing $40 billion share repurchase agreement (that should be completed this year) by another $40 billion buyback plan. While that is a dazzling headline, …

Continue readingTo state the obvious, after a long Summer dirt nap, volatility has picked up over the past 2 weeks after the SPX fell quickly through its 50 day moving average before finding support at a …

Continue readingToday’s price action may or may not be the start of a period of greater stock market volatility… I’ll let you know the answer soon enough 😉 But one thing is certain with today’s 2% …

Continue readingDespite the S&P 500 (SPX) very near all time highs, up nearly 7% on the year, Biotech stocks are one of the only S&P sectors down on the year, with the S&P Biotech etf (XBI) down a whopping …

Continue reading