The nearly 2% decline for the S&P 500 (SPX) in October was its first monthly decline since February (down 41 bps) and worst since January’s 5% decline. I have no idea if the SPX is merely consolidating above …

Continue readingSPX

You know the drill… BOJ, Fed, Oct Jobs this week. Election next. I suspect BOJ surprises to the downside on less than expected commitment to monetary stimulus, but will be muted. I expect the Fed …

Continue readingThe S&P 500 (SPX) took a brief hit this afternoon after the FBI announced to Congress they are reviewing new emails recovered from then Secretary Clinton’s private email server. After the quick 1% drop, the …

Continue readingEvent: Verizon (VZ) reports Q3 results tomorrow before the open. The options market is implying a 2% one day post earnings move, which is essentially in line with the 4 quarter average. Price Action / …

Continue readingShares of Netflix are up 17% as I write after releasing Q2 results showing far better than expected streaming subscriber additions. They also guided Q4 higher. This comes after two consecutive quarters of worse than …

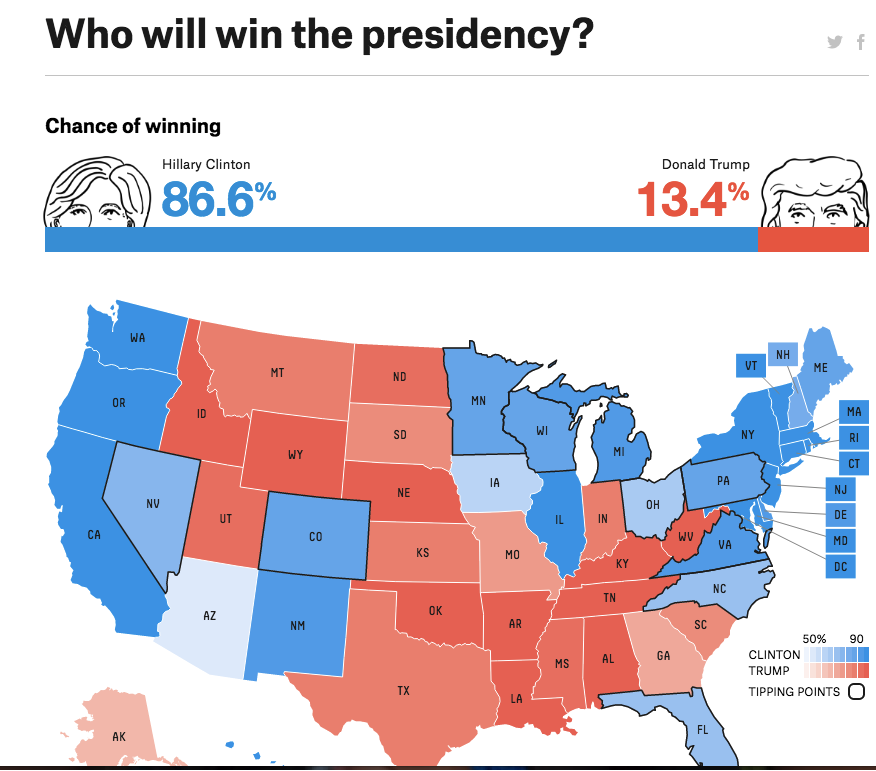

Continue readingIt’s been my view for some time that on top of the very large list of risks to a fragile U.S. economic recovery (and increasingly vulnerable global financial markets) is the election of Donald Trump to be …

Continue readingThe S&P 500 (SPX) clawed back a good bit of its early 1% losses by days end. One noticeable theme in today’s trading was options traders rolling existing positions: GS: bank stocks under-performed the broad market most of the day, with …

Continue readingIn 2015 the energy sector, measured by the S&P Energy Select etf (XLE) was the worst performing group, down 22%. In 2016, the XLE is the best performing group, up nearly 20%. As we barrel into year end, …

Continue readingAs unpredictable the first half of 2016 were in financial markets, the back half is proving to be stranger. The 12% peak to trough decline in January & February caught most off-sides, and then again with the post …

Continue readingYesterday’s price action across most major risk asset classes was a clear indication that investors are re-positioning for rate tightening cycle. Let’s quickly refresh The S&P 500 (SPX) was down 0.5%, the yield on the …

Continue reading