Today was clearly a risk off day, stocks down, commodities down, bonds up, gold up US$ up… you know the drill despite having done your best to erase those events from your memory since early …

Continue readingQE

Last night on CNBC’s Fast Money, the group of equity-centric buffoons, of which I am most certainly one, had a short discussion of the impact of negative interest rates on large banks, and specifically Jamie …

Continue readingThe Energy Select etf (XLE) has had a nice bounce from the lows of earlier this year, largely driven by a stabilization in energy prices that had been steadily declining over the past two years. …

Continue readingCrude oil and the dollar have been the source of much of global market volatility across asset classes the past year. The end of QE in late 2014 caused the dollar to emerge from its …

Continue readingMuch of the volatility in global risk assets since mid 2014 is a result of 20% rally in U.S. Dollar (DXY) from its May 2014 lows to its March 2015 highs: The DXY rallied as …

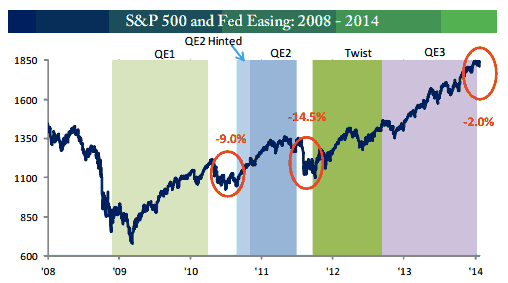

Continue readingQE induced V & W bottoms in the U.S. stock market have been a hallmark of the bull market rally since the financial crisis. You know the drill, stocks lagged without the tailwind between bouts …

Continue readingBear with me, this is a bit of a think piece, it’s not likely to help you make money, merely some ramblings on what was a fairly confusing last couple days in global financial markets: Earlier …

Continue readingYesterday I highlighted the violent upward reaction in global equities and the Euro following the ECB’s announcement of monetary easing measures. By the end of the day European equities had traded in a 5% range, …

Continue readingEarlier today in my MorningWord I highlighted the conundrum of the data dependent U.S. Federal Reserve, faced with U.S. economic data hitting their prior targets for employment and inflation and the possibility for renewed tightening, vs the …

Continue readingYesterday in this space we addressed the question on most investor’s minds. Was the reversal in global equity markets late last week the start of the sort of V reversal that we have become so …

Continue reading