AutoZone (AZO) reports fiscal Q4 results tomorrow before the open. The options market is implying about a 3.25% one day move which is essentially inline with its long term average. AZO saw a 12% (or …

Continue readingFOMC

To state the obvious, after a long Summer dirt nap, volatility has picked up over the past 2 weeks after the SPX fell quickly through its 50 day moving average before finding support at a …

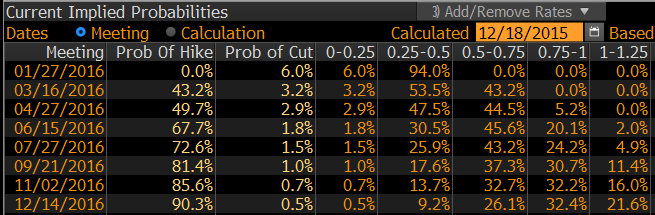

Continue readingUnless you invest from under a rock, you know that the Federal Reserve meets next week to debate interest rate policy. Fed Fund futures are currently pricing about a 20% chance that the Fed will …

Continue readingThis morning I had some thoughts on interest rates (MorningWord 9/14/16: Basket of Predictables). To recap, I don’t think they are going meaningfully higher anytime soon. Maybe we get back to 2.25% in the 10 …

Continue readingWill they? Won’t they? The financial press (and it seems the political press too) can’t stop with this. Yep, because it’s election season, everyone is playing the guessing game on a possible Fed rate hike …

Continue readingEarlier, Dan reiterated a point we’ve been making here on the site, in that vol is historically cheap, based on historically low actual volatility through July and August. As JP Morgan’s Marko Kolanovic pointed out …

Continue readingBeing wrong about the direction of a stock, or a market is part of this business. What I have found in my nearly two decades trading in financial markets is that embracing the fact that …

Continue readingThe other day we updated a position in the emerging market etf EEM. I got a good question in our QnA section on that roll as far as why we did it and why we …

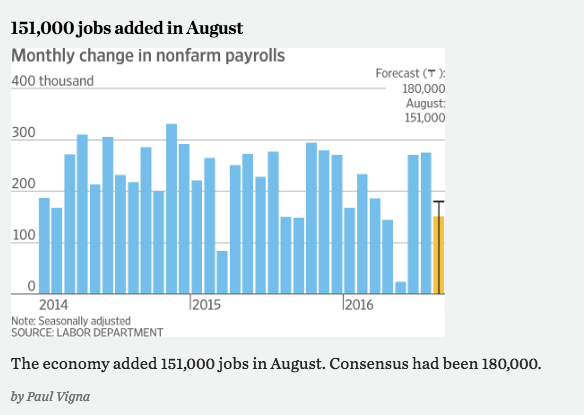

Continue readingIn case you missed it before your holiday weekend sign-off, the August non-farm payrolls came in below expectations at 151,000 jobs added (vs 180,000 consensus), well below the 2016 average of 182,000 and well below the …

Continue readingOn August 16th we initiated a bearish position in EEM, the emerging markets etf. The trade we landed on looked to fade the lack of volatility into Labor Day weekend in order to finance November …

Continue reading