Shares of Celgene (CELG) got slammed in October, from above $140 to below $100 in the span of a few weeks. We took a look at the stock in late October when it was around $100 and for those looking to do a little bottom fishing, detailed a defined risk way to play for some short-term stabilization in the stock followed by a potential (partial) gap fill higher into 2018. Here was the trade, from Oct 30th:

Defined Risk Bullish

Buy CELG ($100) Dec / March 105 call calendar for $3.50

- Sell to open 1 Dec 105 call at $2.50

- Buy to open 1 March 105 call for $6

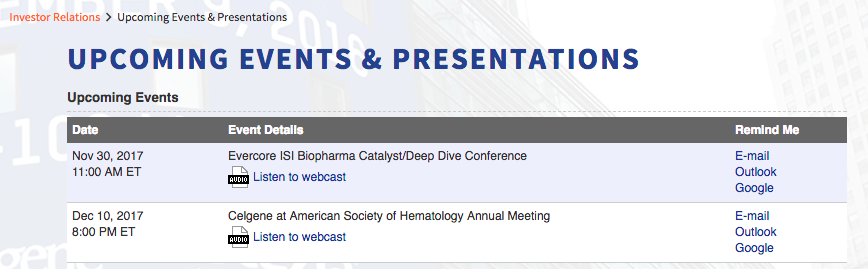

The stock did indeed stabilize, but not until recently did it look to make any sort of move higher. But now it has, and with the stock near our short strike it’s a good time to check in on the original trade and see if it needs to be managed. With the stock near $105 this trade is now worth 4.50. That’s a nice little gain but it won’t be a big gain with the stock here until the Dec short calls decay more. Celgene doesn;t report earnings until January but they will appear at a few healthcare conferences over the next few weeks. From the company’s website:

As far as trade management here, one needs to be careful to let this stock get much above the 105 strike as it will then become short deltas, which is clearly not the intention. The more time the stock spends around 105 in the next few weeks the better this trade gets, quickly. So I think a tight stop here makes sense, maybe before the stock gets to 106, a roll out and up, to Jan 110 calls would be about even money (for the roll) allowing a little more room for the stock to run while keeping overall risk about the same. But the more patient one can be on that roll, the better, as the Dec calls will decay at a faster rate than anything out in Jan and beyond.

I’m not sure how important that Evercore presentation is, but that’s something to keep an eye on this week, if the stock starts to feel more volatile into that event that may be another reason to allow for some room to the upside in case the stock catches a quick bid. On the flipside, if the stock get’s slammed again a stop to get out for even would probably be around $100.