In my continuing Shopping Cart series, looking at stocks of high-quality companies that have been hit hard but have the strong likelihood to rebound hard when we get some visibility on just how long the global economy will be under extreme stress. Without visibility, most consumer-facing companies like Starbucks (SBUX) will likely continue to make lower lows.

Shares of SBUX are down 28% on the year, vs the S&P 500 (SPX) which is down 20%, One reason for this underperformance is their exposure and growth expectations in China, and the guidance they gave about the region on March 6th, per Credit Suisse on March 6th in a note to investors:

Since then we have seen Italy, Spain, and France go on full lockdown and the U.S. this past week has been pushing hard social distancing. Analysts have been aggressively lowering eps growth forecasts, as of now expected to be flat in 2020, which will easily be down when it is all said and done:

The analyst consensus is still calling for a 5% YoY revenue growth will likely be revised lower when you consider that a hypothetical 10% revenue decline would equate to a 20% YoY decline from current expectations:

Stocks like SBUX that normally trade at a premium to its peers and certainly the broad market will be made to look very expensive as numbers get slashed but savvy growth investors who have a sense for valuation, specifically those who prefer to pay up for growth… at a reasonable price (GARP) will likely start to dip their toe’s in the water down 50% from all-time highs. It is worth noting that a 50% peak to trough decline from last summer’s all-time highs is at the low end of the massive consolidation range from early 2015 to late 2018.

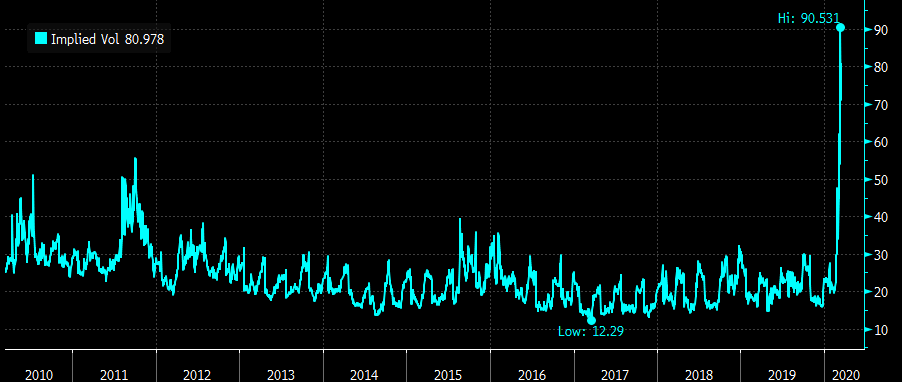

So trying to buy the stock here, despite the extreme oversold short-term nature seems like buying a falling knife given all of the unknowns of their business, if the company were to close all stores as Apple (AAPL) just did then where is the bottom for this stock, does I have a 4 handle on it?? Picking bottoms can be messy work, using options to do so to better define risk can be useful took in your tool-kit, but make no mistake, buying options to do so can be hard, and selling options outright can be risky business. Look at 30-day at the money implied vol (the price of options) at 80%, down from last week’s highs at 90%:

Call calendars will make sense in this environment, selling an out of the money short-dated calls helping to finance the purchase of a longer-dated call of the same expiration. On March 5th I detailed a similar strategy in Disney (DIS), read here.

Stay tuned. SBUX is in the cart.