Yesterday the backers of the latest James Bond movie, pushed its release date from early April to November as a result of the spread of the coronavirus, per Variety:

The film was originally supposed to be released internationally on April 2 and in the U.S. on April 10. However, the spread of coronavirus has led to closures of theaters in major markets such as Italy, South Korea, China and Japan. That could have been a major blow to “No Time to Die,” which cost more than $200 million to produce and millions more to market. Given that hefty budget, the film will need to perform well in international markets if it wants to make a profit.

The studio is likely making a smart decision given how much it costs to promote a blockbuster like a Bond movie, relative to its production budget, for fear that people will not go to movie theaters. My immediate thought when I saw this news was that I could not think of a better time to explore alternatives to wide movie theater releases, especially when you consider the success of recent releases like The Irishman on Netflix late last year.

Oh and shares of Netflix (NFLX) have clearly benefited from consumer fears of being out and about, and go to large gathering places like movie theaters, NFLX is within a couple of percent of its 52-week highs, up nearly 20% on the year and up 53% from its 52-week lows in September:

The timing of the virus, and the perceived benefit to NFLX’s subscriber base, is that it comes after a few quarters of rocky subscriber additions leading investors to think their best days in North America behind them.

The decision to move the theatrical release of the Bond movie six months struck me as odd considering one of the biggest shifts in media in decades (obviously championed by NFLX), to direct to consumer that the studio behind this movie did not look to try something bold and strike a deal for distribution with a service like NFLX.

Extrapolating this theme out a bit, movie theater closures in China and Europe are likely to weigh heavily on, Disney this Spring with expected releases of Mulan, Black Widow and Pixar’s Soul (among many others). This comes on top of Disney’s indefinite closure of the Hong Kong and Shanghai theme parks. But Disney has spent the last few years reading their DTC platform Disney+ and their essential takeover of Hulu that the time could not be better for Disney to try to roll out at least some of these movies in an effort to catch up to NFLX’s sub-base but also prove the concept of their service with the combination of their beloved content.

Shares of DIS have gotten taken out to the woodshed this year down 20% on the year, down 25% from its 52-week highs and down 18% in just the last two weeks as the company’s consumer-facing and global businesses will most definitely be hit hard as long as the coronavirus is weighing on consumer spending. The stock’s decline has sliced through what many thought would be long term support for years near $120, but the sell-off might be nearing exhaustion as it gets closer to $110:

I suspect DIS will be a bit more creative with their upcoming movie releases and while it may weigh on earnings, it could be the sort of thing that reassures investors that the company is a much more nimble player in the new and emerging digital landscape. It’s my view that as soon as the hysteria dies down regarding lockdowns of consumer behavior, stock’s like DIS with premier brands and products will recover some of their losses very quickly.

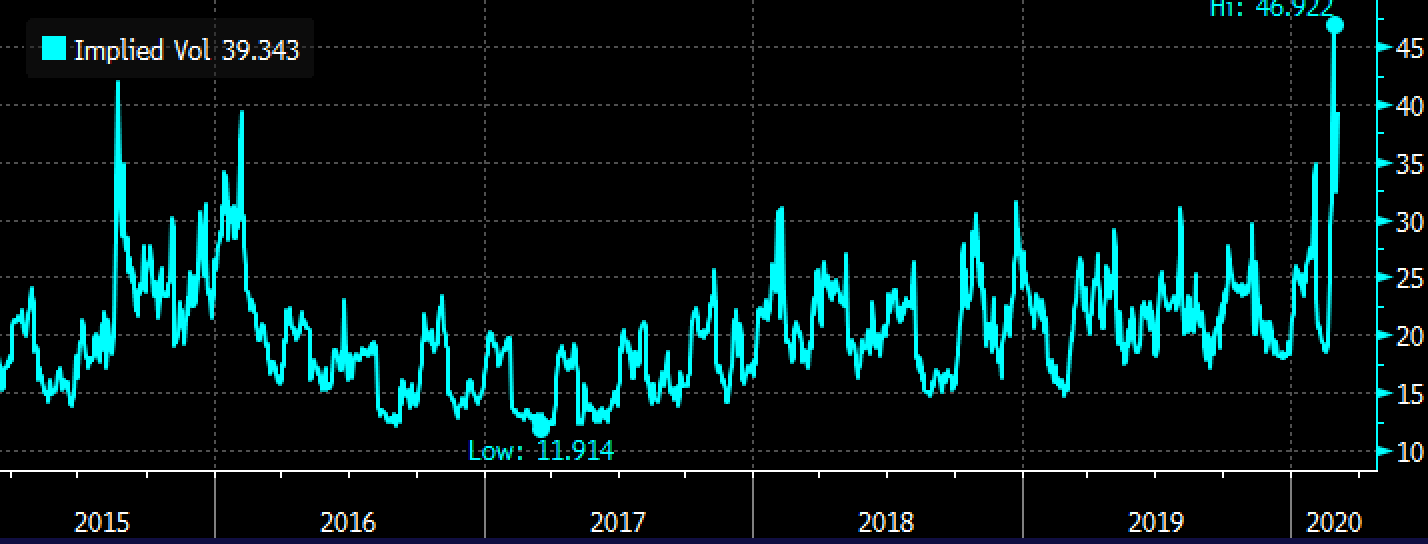

As one might expect, short-dated options prices have spiked in DIS, with 30-day at the money implied volatility at 39%, down from the recent multi-year high at 46%, but making long premium directional trades challenged.

So what’s the trade?

It is my view that times of uncertainty like the one we are in now presents opportunities for companies to rethink how they can better serve their customers, and importantly innovate in real-time. If there was ever a company that could use the earned political capital with its customer base it is DIS and if done properly, like offering a limited release of highly anticipated movie titles on Disney+, then the company could redefine the movie industry, again, as we know it. This could ultimately prove to be very helpful for shares of DIS.

But given the uncertainty as to when the virus will abate, and consumers will start going back to theme parks and movie theaters, calendar spreads (selling short-dated options premium that are elevated to help finance the purchase of longer-dated premium) make a lot of sense.

For instance…

Bullish Trade Idea: DIS ($115) Buy April – June 130 call calendar for $1.65

-Sell to open 1 April 130 call at $1

-Buy to open 1 June 130 call for $2.65

Break-even on April expiration:

The ideal scenario is that DIS stock is near 130 on April expiration and the short 130 call expires worthless or can be covered for a small amount and you are left long June 130 call for $1.65 or about 1.5% of the stock price.

The max risk of the trade is $1.65 on a sharp move lower than current levels or a sharp move above the $130 strike price.

Rationale: this trade idea risks about 1.5% of the stock price and allows to leg into some upside exposure over the coming months. To my eye, near-term $130, which had been technical support since last April could serve as near-term technical resistance, but once the virus has moved on, or is perceived to be less of a risk to consumer spending, then stock’s like DIS should make back some of their recent losses: