In early December Dan checked in on Electronic Arts (EA) and detailed a bullish trade that targeted its February earnings while financing that call purchase with the sale of a nearer dated call of the same strike. Here was the trade idea from Dec 10th and some rationale for the calendar:

EA ($83.30) Buy Dec 28th weekly / Feb 90 call calendar for $3

-Sell to open 1 Dec 28th weekly 90 call at $1

-Buy to open 1 Feb 90 call for $4

This trade performs best with a gradual move towards the 90 strike over the three weeks into Dec 28th weekly expiration. If the stock is below 90 on Dec 28th weekly expiration the short 90 call will expire worthless and the trade will be left naked long the Feb 90 call. If the stock is close to 90 then the Feb 90 call should have appreciated as it will have picked up deltas. At that point it might make sense to further reduce the premium at risk by selling a higher strike call in Feb turning the trade into a vertical call spread. The max risk f this trade is the $3 premium paid, and would be at risk with a large move below the current level, or well above the 90 strike.

Despite the craziness in the market that’s exactly what has happened in the stock, with the post Christmas rally taking the stock up to near 90, but allowing that Dec 28th 90 call to expire worthless. Now with the stock above 90, and the position simply the Feb 90 call it’s time to look at the second part of the rationale, and further reduce cost into February.

With the stock now 90.50 the Feb 90 call (expiring Feb 18th) is worth about 5.40, versus the original 3.00 net cost. I really like the idea of calendars like this after a big fall in a stock or the overall market because it allows you to sell the front month at a fairly high vol versus the normal conditions of selling low vol to buy higher earnings month vol. Alot of people get scared of call calendars after big down moves because getting back to that strike can seem too tight, and not ‘bullish’ enough, but the higher vol is a godsend under those conditions and the call sale near term really helps.

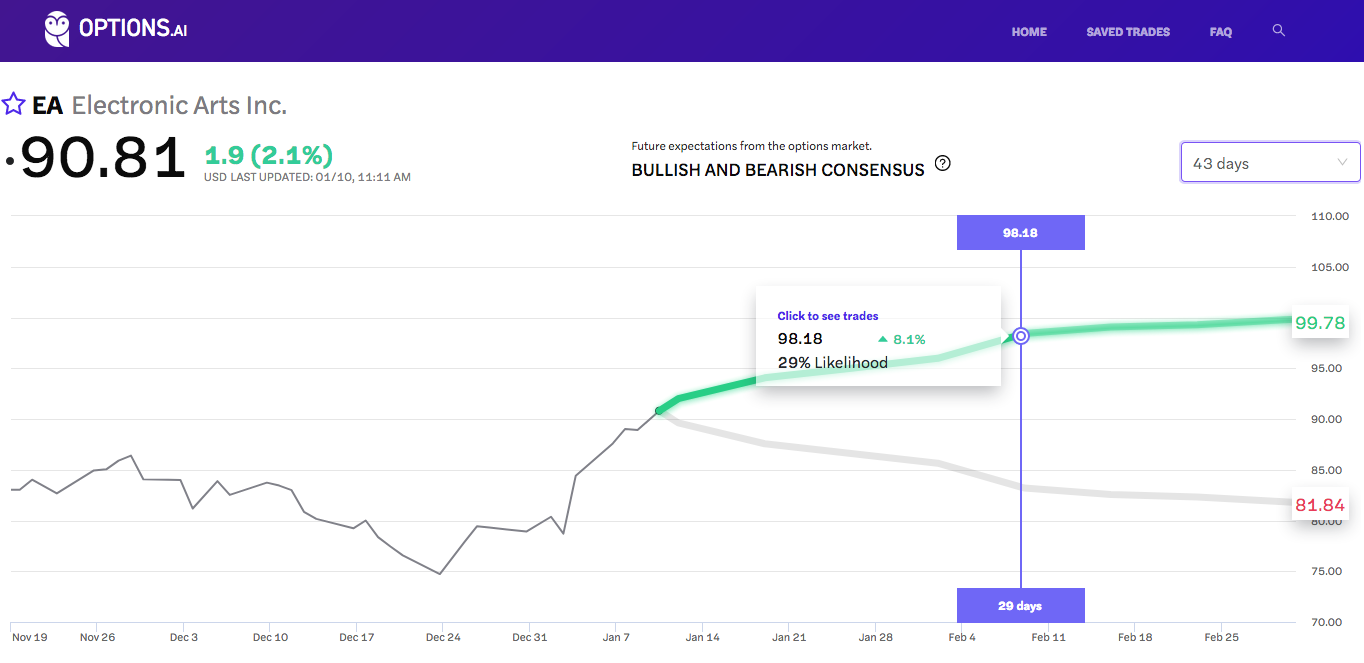

So now we can look at some realistic moves from here higher to select our strike to sell in February. Checking in on Options.ai we can see that the bullish expected move for earnings would put the stock at about $98 on a move higher (with a 29% likelihood):

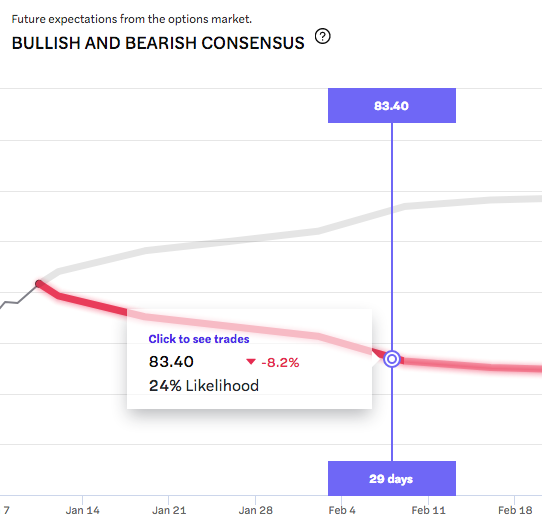

Incidentally, the likelihood of a similar move downward on earnings is only 24%, indicating some outsized demand in upside calls into the event:

But what that tells us is that the 100 strike is a fairly safe one to sell and a good area to target. Right now those calls are about 1.65, which would mean owning the Feb 90/100 call spread for a net price of 1.35, with the opportunity to make up to 8.65 if the stock is at or above 100 on Feb expiration.

For those looking to lock in the trade for free, the 95 calls in Feb could be sold at 3.10 (even locking in .10 in current profits) with the ability to make up to $5 if the stock is above 95 on February expiration. That of course is the more high probability roll here, but obviously leaves alot less upside potential for those looking for a bigger bounce.

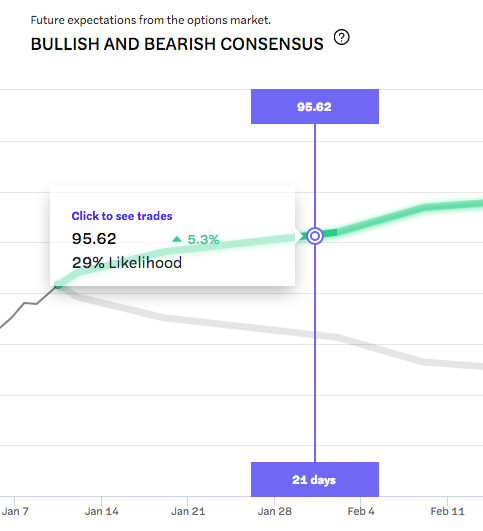

And a third roll option is to roll but continue the calendar positioning. Earnings are expected for 2/5 so the 2/1 expiration is one to look at and in that case the 95 strike is about at the expected move for 2/1:

Right now those Feb-1st 95 calls are about 1.50 which would reduce cost to just 1.50 overall and allow for ANOTHER roll into the event, should the stock be at or below 95 on Feb 1st. I really like that option.