Dan previewed Oracle (ORCL) earnings into their December 17th report and detailed a mildly bearish trade idea. Similar to other tech stocks that reported in November and December it just seemed like with the mood of the market that the up down risk/reward into the print was asymmetrical to the downside. ORCL didn’t move a ton after the report but obviously got a little swept up in the broader market volatility that followed. To recap, here was the original trade idea, from Dec 17th:

ORCL ($46.25) BUY JAN 46 / 42 / 38 PUT BUTTERFLY FOR 80 CENTS

-Buy to open 1 Jan 46 put for 1.95

-Sell to open 2 Jan 42 puts at 70 cents or 1.40 total

-Buy to open 1 Jan 38 put for 25 cents

With ORCL now slightly lower, at 45.10, this put fly is worth about 1.15 mark to market. Intrinsically, meaning if the stock closed at exactly this point on expiration, the fly would be worth only .90. Therefore, the trade is still definitely at risk, both from a directional standpoint if the stock were to rally from here, but also on from a premium perspective as it could still lose value even if it went sideways. Therefore from a trade management standpoint it makes sense to keep a pretty tight stop to the upside, I wouldn’t let the stock get above 46 for sure, especially if it looks market participants in January try to make up for some of the selloff we saw in December. On the flipside, patience would be rewarded if the market sold off, as this trade can be worth up to $4 with the stock down near 42.

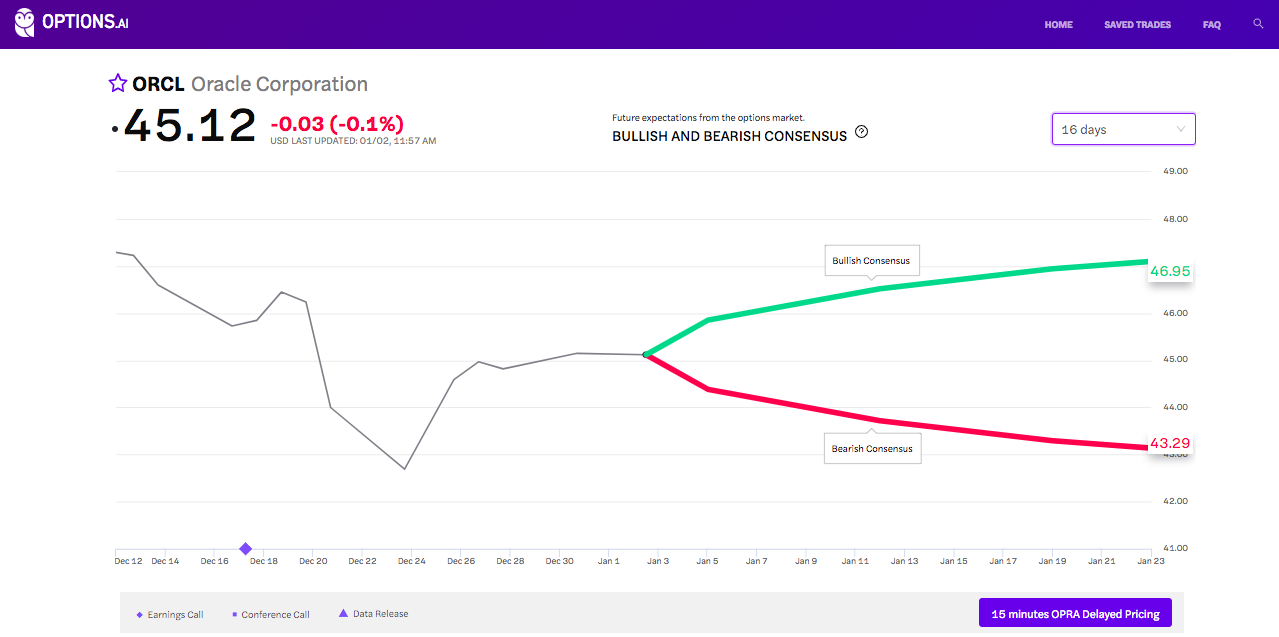

Here’s the expected move up to January 18th from Options.ai: