Dan looked at Costco (COST) stock into its earnings last week and noticed a descending wedge on the chart. That, combined with broad market conditions where rallies are quickly sold meant that a big beat and raise would likely be necessary for any significant move higher while the slightest disappointment could send the stock asymmetrically downward. With that in mind he looked to a put spread, targeting a move lower to $210. Here was the trade idea, from Dec 13th:

Bearish Trade Idea: COST ($226.50) Buy Dec 222.50 / 210 put spread for $2.50

-Buy to open 1 Dec 222.50 put for $3.50

-Sell to open 1 Dec 210 put at $1

COST did in fact get hit pretty hard, initially to 210 on the report and now following through lower. With expiration around the corner let’s check in on the trade. With the stock now 205.50 this trade is worth about $12.10 versus the initial cost of 2.50. Not bad! The max it can be worth if the stock closed below 210 on Friday is 12.50 so this trade is basically maxed out and can be closed at anytime.

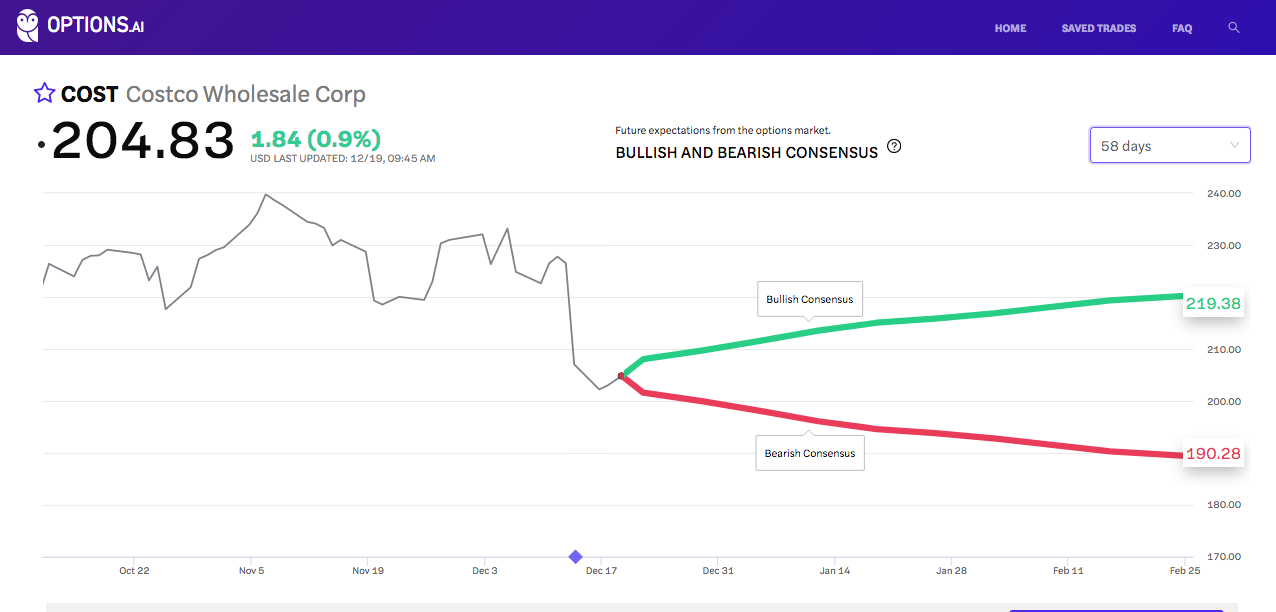

As far as what’s next in the stock, the options market is pricing an expected move of 220 on the upside and 190 on the downside over the next two months: