On Friday Feb 9th I took a look at the trade set-up into Walmart’s (WMT) upcoming earnings events (read here), and had the following to say:

Well earnings disappointed, the stock filled in that gap, and the way I detailed to play for a bounce is a defined risk loser. Here was the trade idea from Feb 9th:

TRADE IDEA WMT ($100) SELL THE MARCH 97.50 / 92.50 PUT SPREAD AT $1.50

-Sell 1 March 97.50 put at $3.80

-Buy 1 March 92.50 put for $2.30Break-even on March expiration:

-Profits of up to 1.50 between 96 and 97.50, max profit of 1.50 above 97.50

-Losses of up to 3.50 between 96 and 92.50, max loss of 3.50 below 92.50

With the stock at $93 this trade idea to sell the March 97.50/ 92.50 put spread is worth about $3.65, or about a 2.15 loss. If the stock were to close below 92.50 on March expiration, the trade would lose the full $3.50. So at this point, it depends where you think the stock goes in the next few weeks.

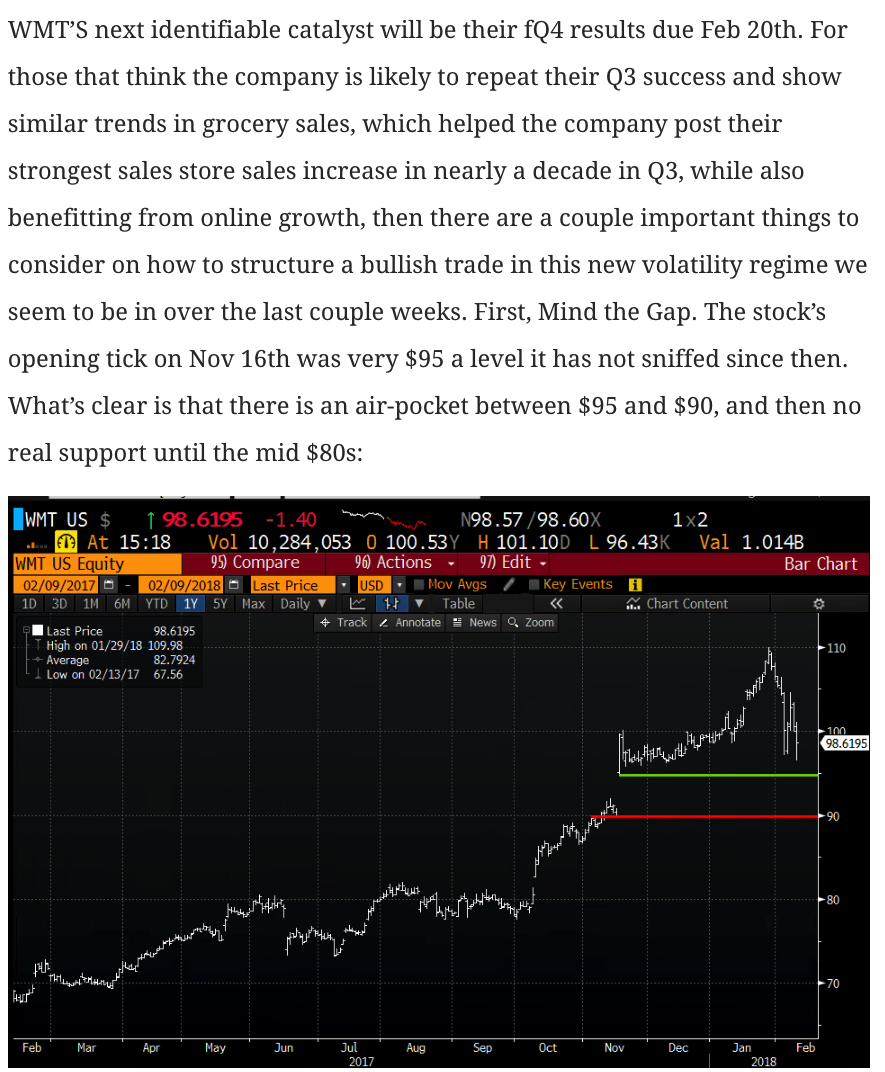

The five-year chart below is pretty interesting to my eye. The late 2017 breakout at $90, which the stock nearly kissed last week, nearly filling in the entire gap, should serve as massive technical support:

Just because it is massive support, does not mean it can’t be broken, and $90 should serve as a stop for those who are long as there appears to be an air-pocket in the chart down to $80.

For the next couple weeks though I am willing to bet that the stock bounces a bit and regains a little ground. On a pop above $95 I would look to exit this trade mitigating some of the current loss.

But If i were coming to the stock fresh, and considering playing for a bounce back to $100, the implosion in options prices might sway me to flip from the short premium strategy I detailed on Feb 9th, to a defined risk long premium strategy:

So what’s the new bullish trade idea?

WMT ($93) Buy March 93 / 96.50 call spread for $1

-Buy to open 1 March 93 call for 1.45

-Sell to open 1 March 96.50 call at 45 cents

Break-Even on March expiration:

Profits of up to 2.50 between 94 and 96.50 with max gain of 2.50 above 96.50

Losses of up to 1 between 93 and 94 with max loss of 1 below 93

Rationale – Options prices have fallen following earnings. If the stock were to continue this bounce it could easily see the 96.50 target and in that case the 2.50 profit vs 1.00 risked is a good set-up. If the stock is unable to continue its bounce, just 1.00 is risked, even if the stock breaks down.