Regular readers are aware of the fact that I fund the concentration of the weighting of a handful of stocks in the Nasdaq 100 make the QQQ, the etf that tracks the index a fairly …

Continue readingThis morning on CNBC Warren Buffett, the largest holder in IBM (with nearly 9% of the shares outstanding), said he is not sure if he’s made a mistake owning the stock, but he has not sold …

Continue readingOn February 19th I tweeted the following chart. It’s a three year chart of the Value Line Arithmetic index, an equal weighted measure of 1700 or so U.S. stocks: The Value Line Arithmetic,equal weight 1700 …

Continue readingBuying the dip in a market like this comes with some high risk but also the potential for high reward, especially in single stock names. We highlighted two such names the past few days Recently …

Continue readingIn case you missed it, I am not a buyer of stocks after the 8% rally in the S&P 500 (SPX) from its 52 week lows made Feb 11th. Regular readers know that I feel quite …

Continue readingFor the better part of the last 6 months, investors have been fairly clueless as to where to park cash with the prospects of a reasonable risk adjusted return. The global volatility in credit, currencies, commodities …

Continue readingThe volatility in oil lately created a fairly attractive opportunity for those inclined to sell options, and making it quite difficult for those looking to express directional long premium views as options prices in oil stocks (especially highly …

Continue readingEvent: Baidu (BIDU), the Chinese internet search giant reports Q4 results tonight after the close. The options market is implying almost a 9% one day move tomorrow. With the stock around $157.50, the weekly 157.50 …

Continue readingEvent: Palo Alto (PANW) reports their fiscal Q2 results tonight after the close. The options market is implying about a 10% one day move, which is rich to the 4 quarter average of about 5%. …

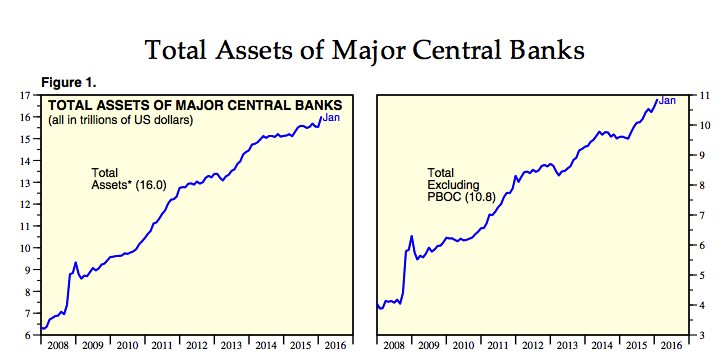

Continue readingRegular readers know that macro ain’t exactly my bag, I’m more of a U.S. stock/options monkey. But every so often a headline outside my wheelhouse catches my eye and I dig a little deeper. Like …

Continue reading