Retail stocks, badly beaten up last year are showing fairly decent relative strength so far in 2016, with the XRT, the S&P Retail etf down only 2.5% vs the S&P 500 (SPX) down 5.5% on …

Continue readingEvent: SalesForce.com (CRM) reports Q4 results tonight after the close. The options market is implying about a 9% one day move, which is rich to its 4 qtr average one day move of about 5.5% …

Continue readingYou may have noticed a trend in some of our trading lately, buying outright puts near what we feel are inflection points adter market bounces/rallies and not spreading them right away, but rather waiting to …

Continue readingDan gave his latest thoughts on JPM this morning. We have an existing short delta trade that we’ll now update and reduce some premium risk. The original trade idea was a put calendar when the …

Continue readingLast night, on CNBC’s Fast Money program we discussed the JP Morgan’s (JPM) investor day that had the stock down 4% yesterday. JPM CEO Jamie Dimon portrayed a calming tone, despite acknowledging headwinds to his business, having …

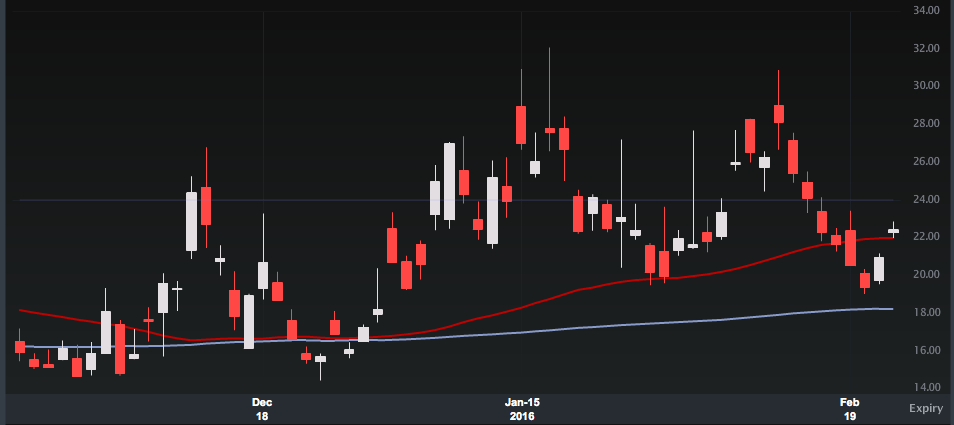

Continue readingShares of Disney got whiggidy whacked the day after their fiscal Q1 earnings on Feb 9th, closing down nearly 4% at a new 52 week low. Investors remain more concerned with subscriber losses at ESPN than relieved …

Continue readingThe Nasdaq 100 (QQQ) had been a pretty boring trading vehicle for a while, as some of its large components had been in a fairly complacent upward trajectory for what felt like years. But then …

Continue readingIn early February we expressed a bearish view in shares of The Home Depot (HD) and closed for a profit after a drop in the stock (read here). Following this morning’s very strong earnings results …

Continue readingEverybody I read and listened to called it. The S&P 500 (SPX) was going to test the August 24th lows, then test the October 2014 lows then bounce back to 1950. If you came into …

Continue readingU.S. stocks opened up more than 1% and have traded in a fairly tight range for most of the session, in a 7 point range: After being down a little more than 6% on the month …

Continue reading