Doug Kass of Seabreeze Partners earlier issued a Tweet-memo to “talking heads”: Memo to all the “talking heads” in the business media: 20K in the DJIA is meaningless. It is meaningful to those that need …

Continue readingZIRP

Next week the Federal Reserve will raise short term interest rates for only the second time since June 2006, and the first time this year to a range of 50 to 75 basis points. Financial …

Continue readingRemember the Taper Tantrum in 2013? Seems like a distant memory. But the U.S. Fed floated the trial balloon that they would start tapering bond purchases from their QE highs of about $85 billion a …

Continue readingFears of a recession in the U.S. following the late June Brexit vote in the U.K was one of the main reasons for the 5% drop in the S&P 500 (SPX) and the new lows made …

Continue readingECB and OPEC are the stories of the day. Sadly, I have little intelligent to add. So I won’t attempt to opine on what Mario Draghi, or the Saudi’s did or didn’t do. All I …

Continue readingIntel (INTC) reported Q1 results and forward guidance last night after the close. While the Q1 results hit the previously lowered estimates, Q2 sales were guided to $13 to $14 billion, below the consensus of …

Continue readingThis morning, Bloomberg reported on short interest in U.S. equity markets reaching levels not seen since 2008, with the suggestion that this could serve as a contrarian set up, quoting Fundstrat Global Advisor’s Thomas Lee, who opined: “There’s …

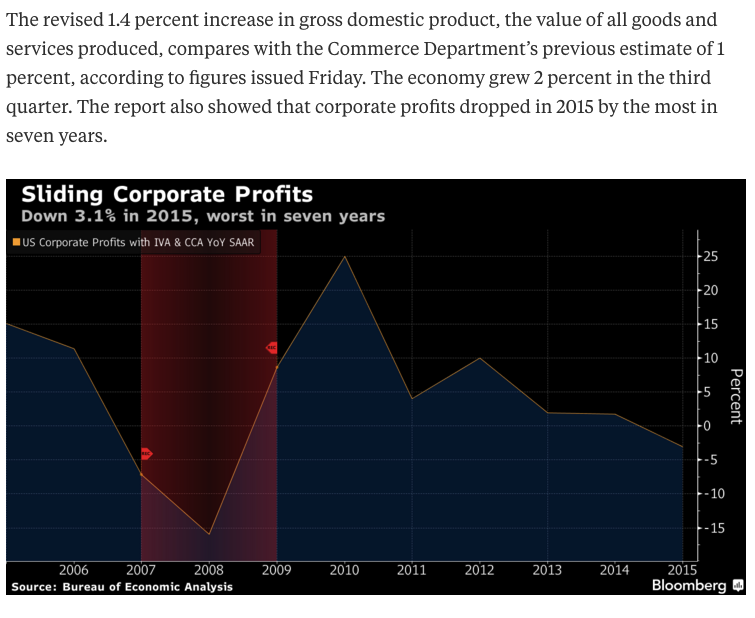

Continue readingIn case you missed it, on Friday, Q4 2015 GDP was revised, per Bloomberg: Another Bloomberg story, dissecting the Q4 GDP, lays out a concern: Yet beyond the headline number, there is a reason for some …

Continue readingIt’s been exactly three months since the U.S. Federal Reserve raised interest rates from zero. A lot has happened since then in global financial markets, but looking at the year to date performance of some …

Continue readingMuch of the volatility in global risk assets since mid 2014 is a result of 20% rally in U.S. Dollar (DXY) from its May 2014 lows to its March 2015 highs: The DXY rallied as …

Continue reading