Here is some untied options trades that caught our attention in today’s trading: DXJ: the etf that tracks Japanese equities on a currency hedged basis saw what appears to be a roll up in calls. …

Continue readingXOP

Here are some apparently directional untied options trades that caught our attention in today’s trading:

Continue readingHere are some apparently directional untied options trades that caught our attention in today’s trading: While WTI Crude has been fairly range-bound, trading between $40 and $50 since late April, the commodity is finding some technical …

Continue readingAAPL: The largest single stock options trades today were in Apple:

Continue readingHere is some apparently untied directional options activity that caught my eye in today’s trading: XRT: the S&P retail etf is down about 10% from its August highs, one of the worst performing S&P sectors …

Continue readingHere is some large siazable options activity that caught my eye in today’s trading: XOP: the S&P Oil & Gas etf was down more than 2% as Crude Oil has one of its worst days in …

Continue readingIn the last month and change we’ve focused some short delta ideas that have some similar themes (e.g. increased chances of recession Europe post Brexit). We expressed those views in 3 etfs in particular that …

Continue readingThe financial world is picking up the pieces of yesterday’s Brexit vote. The price action in most major risk assets, shows just how much the Leave vote caught market participants off-sides. While it is still not clear …

Continue readingThe OPEC meeting came and went this past weekend, and as the investment world is well aware, after a sharp but brief drop yesterday, Crude Oil is trading very near the levels where it closed …

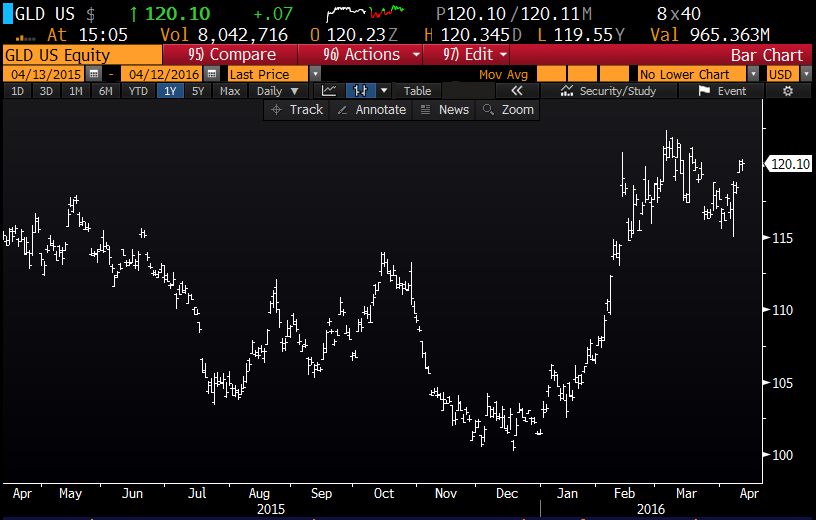

Continue readingHere are a few long premium directional options trades that caught my eye in today’s trading: GLD – since the Gold’s ramp off of 52 week lows in mid December to new 52 week highs …

Continue reading