Here is a couple of untied options trade that caught our attention in today’s trading:

Continue readingXLK

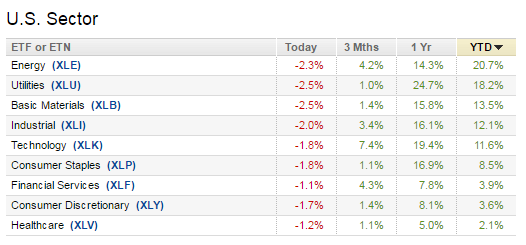

I sincerely have no idea whether the rotation out of growth stocks, primarily Tech, and “yield-ers”… Consumer Staples, Telco and Utilities, into Banks, Industrials, Materials and Oil stocks is healthy with the broad market at all …

Continue readingHere is some apparently untied directional options trades that caught our attention in this morning’s trading:

Continue readingHere are a few apparently directional options trades that caught my eye in today’s trading: XLK: There appeared to be an opening bullish bet in the S&P Technology Select etf when the etf was trading $47.70, …

Continue readingOn Friday we detailed a defined risk short trade idea in the XLK, the S&P Technology Select etf, read here. And I talked about it but with a December expiration on Friday’s Options Action on CNBC: …

Continue readingToday’s price action may or may not be the start of a period of greater stock market volatility… I’ll let you know the answer soon enough 😉 But one thing is certain with today’s 2% …

Continue readingLast night on CNBC’s Fast Money, my main technical man, Carter Braxton Worth, of Cornerstone Macro Research (and co-panelist on Options Action) laid out a fairly compelling case for a short entry in the XLK, …

Continue readingOn Friday afternoon I previewed a bearish trade in shares of the Technology Select etf, the XLK (below), and discussed on Friday’s Options Action on CNBC: I think I was pretty clear that I wanted to …

Continue readingEarlier today I offered some thoughts on Q1 earnings season (read here), but the quick take-away as we finish the second full week of results is that stocks that had low expectations and had not …

Continue readingQ1 earnings season is off to a sort of meh start. Last week, bank stocks rallied off of very low expectations, poor relative performance and results that were good enough to cause a bit of …

Continue reading