I know where I was 10 years ago today. I was watching a Ustream live video of Steve Jobs’ introduction of the first iPhone. While Jobs claimed that the device was magical and revolutionary, to …

Continue readingWSJ

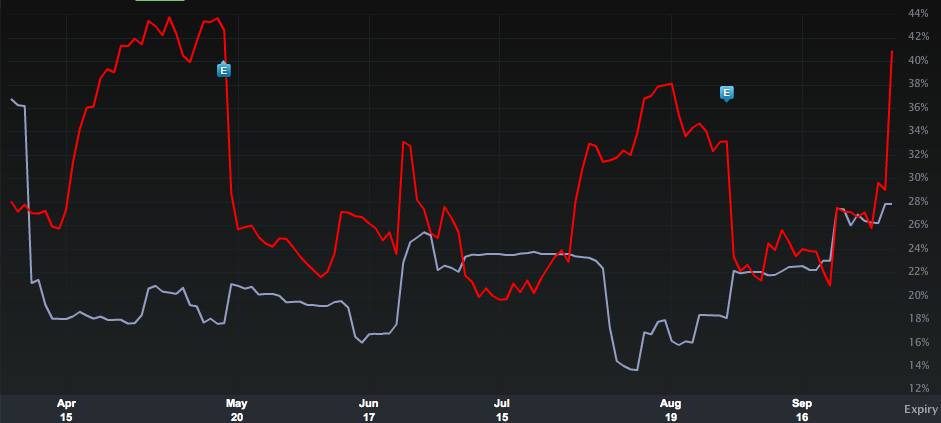

On Friday’s Options Action on CNBC we discussed the out-performance in bank stocks since the presidential election in early November, and the possibilities for a pullback in bank stocks following Q4 earnings results and Q1 …

Continue readingThis morning Venture Beat ran an article (via Reuters) Silicon Valley VCs are growing wary of on-demand delivery, as an investment in such businesses is waning: many VCs have lost faith in a sector that …

Continue readingThere are are no shortages of stocks and sectors that are rallying in anticipation of policy changes in the new administration. Biotech/Pharma and Bank stocks were perceived to be the primary future beneficiaries of more lenient …

Continue readingOn November 3rd, Starbucks (SBUX) issued fQ4 results that were better than expected, despite U.S. same-store sales missing expectations for the fourth consecutive quarter (4% vs 4.8%), with CEO Howard Schultz citing a “high degree of …

Continue readingEvent: Walmart (WMT) is scheduled to report their Q3 results on November 17th before the open. The options market is implying about a 4% move in either direction between now and Nov 18th expiration close. …

Continue readingRegular readers know that most of our trade/ investment ideas start with something fundamental, usually some sort of catalyst, or relative valuation etc, but we also like to use as many inputs as possible to help formulate …

Continue readingYesterday in this space I did a little compare and contrast between expectations into Amazon.com (AMZN) and Alphabet’s (GOOGL) Q3 earnings due out last night (here). In a nutshell, I emphasized: AMZN is likely the one …

Continue readingOn September 8th we took a look at Salesforce (CRM) and determined that there was a strong possibility that the stock would remain under pressure into their Q3 report in November. The main reason being the weakness in billings was unlikely …

Continue readingEvent: FedEx (FDX) reports their fiscal Q1 results tonight after the close. The options market is implying nearly a 5% post earnings move tomorrow in either direction, which is shy of the 4 qtr one day average …

Continue reading