We spend a lot of time discussing corporate quarterly earnings as they represent the potential for unusual volatility around a known event. For a stock market that spends most of its time trading on general …

Continue readingWMT

Event: Walmart (WMT) is scheduled to report their Q3 results on November 17th before the open. The options market is implying about a 4% move in either direction between now and Nov 18th expiration close. …

Continue readingHere was some large possibly directional options trades that caught my eye in today’s trading: GM: Shares of General Motors are having one of their worst days in months, down 4.25% following Q3 results that …

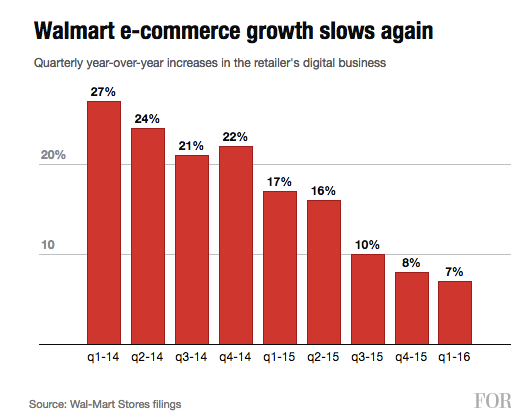

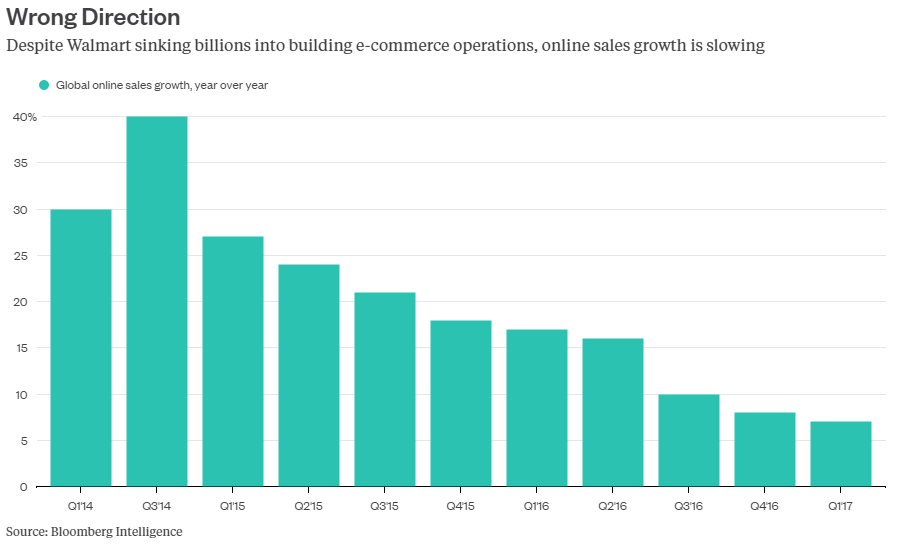

Continue readingWalmart has been a massive out-performer in 2016, up 18% ytd vs the S&P 500 (SPX) up a tad less than 7%, and the S&P Retail etf up 7.5%. Call volume is running hot today …

Continue readingWalmart (WMT) and Target (TGT) have been newsy of late. WMT’ made a $3.3 billion offer for online retailer Jet.com a couple weeks ago, a company who’s store has been live for a little less …

Continue readingTwo weeks ago, Unilever, a company with its origins in Victorian England, and whose mission at that time was ‘to make cleanliness commonplace; to lessen work for women; to foster health and contribute to personal attractiveness, that …

Continue readingEarlier I offered some updated thoughts on the current investment environment (MorningWord 6/28/16: Eyes Wide Shut). In summary, I’m less than sanguine for U.S. stocks. That has been my view since the start of 2015. …

Continue readingOn June 14th, I expressed a near term bearish view in Alibaba (BABA) with a defined risk trade that looked to finance August near the money puts with shorted dated puts of the same strike …

Continue readingWe traded Walmart into yesterday’s earnings (here was the initial trade idea from April 29th, here was the trade management from May 13th, here was the exit from May 18th, and here was the post …

Continue readingShares of Walmart (WMT) are up a whopping 8% this morning after reporting Q1 sales that beat expectations with a same sales stores sales comp of a 1%. The stock is making back a good …

Continue reading