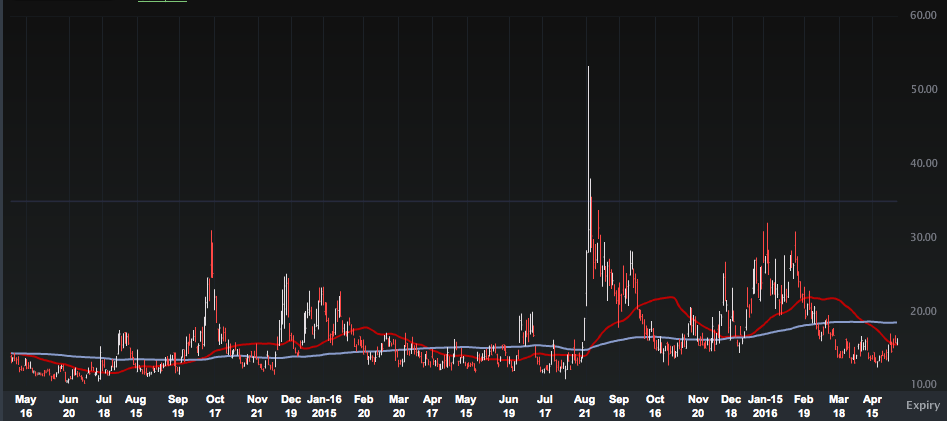

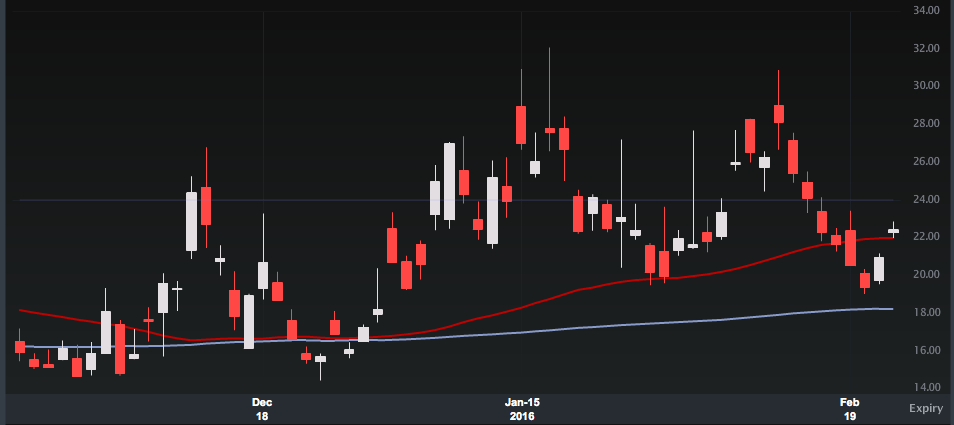

As most of you know, sentiment is a strange bedfellow when it comes to financial markets. It’s usually dire or running hot at the opposing extreme in the actual market, bottoms or tops. I’ve always felt …

Continue readingVIX

You know the drill, even if you’ve forgotten it. But thanks to Larry McDonald updating a Tweet of his from last Summer, here’s a reminder: Here we go again (2)#Dollar#Oil#Debt — Lawrence McDonald (@Convertbond) July 20, …

Continue readingI’m starting to sound like a bit of a broken record, but if someone is looking at the S&P 500 (SPX) up 2% on year and about the same amount away from its May 2015 …

Continue readingYesterday we looked to fade the European stock rally into what markets (and we) assumed would be a Remain vote in the UK with the use of a calendar put spread in the EuroStoxx 50 …

Continue readingI’m not sure I ever recall uttering a positive word about Gold as an fundamental investment in the pages of RiskReversal. I’ve spoken about it from a techincal peespective. And since the shiny metal got …

Continue readingA couple of new volatility products were just released. These are similar to what has come before with the VXX and XIV but instead focus on the weekly VIX futures. Here’s REX Shares founder Greg …

Continue readingYesterday we detailed trades into two earnings events, Nike (NKE) and RedHat (RHT). The two stocks have nothing to do with eachother other than they were both reporting on the same day. But I wanted …

Continue readingThe rally in the S&P 500 (SPX) from last month’s lows near 1800 to today at 2000 was initially powered by some of the most loved and most prominently weighted in the index. But of …

Continue readingEveryone and their mother is going to opine on the jobs data this morning, so I might as well offer my quick thoughts. We will have some more action oriented stuff later. Ok, here I …

Continue readingYou may have noticed a trend in some of our trading lately, buying outright puts near what we feel are inflection points adter market bounces/rallies and not spreading them right away, but rather waiting to …

Continue reading