I understand the current investor mindset as to why most equities are where they are, and for the most part I agree. I think we are in a cautiously optimistic phase opposed to all out euphoria. But …

Continue readingVIX

Volatility Speaks: But what is the Message? In an efficient market, expected returns are a function of market risk as measured by the standard deviation of returns. Implied volatility on market indexes, such as the …

Continue readingThe average price for the last 100 days for the S&P 500 (SPX) has been about 2190, or about 3.5% below Friday’s close of 2271. While the sense is that the stock market surged following …

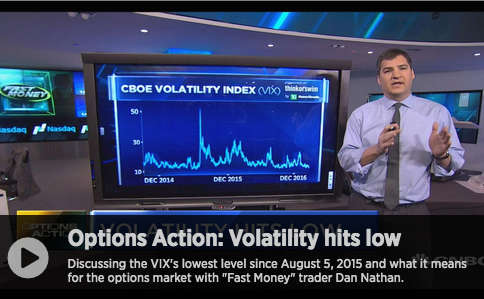

Continue readingLast night on CNBC’s Fast Money they asked me to take a quick look at the VIX (CBOE Volatility Index) trading at 2016 low, briefly below 11 for the first time since Aug 5th, 2015: …

Continue readingGold and Gold mining stocks have been left out of the rally in just about every other risk asset on the planet since early November. While materials and mining stocks (measured by the XLB, the …

Continue readingOn December 2nd we looked at a way to buy a very low VIX with eyes towards today’s FOMC release. The meeting has come and gone and the market is selling off a bit in …

Continue readingShares of Goldman Sachs are up nearly 35% on the year, most of it since Nov 8th, and up nearly 75% from its late June post Brexit lows, and now just 3% from its all …

Continue readingThe retail sector is one of the best performing since the early hours of Nov 9th following the surprise election results, with the XRT (the S&P retail etf up nearly 15%, very near 52 week …

Continue readingHighlighting unusual options activity in VIX options can often times be a useless endeavor as a good bit of the volume tends to be rolls, and often they are traded delta neutral vs VIX futures. …

Continue readingAlright, maybe it’s starting to sound like the boy who cried wolf, or merely my fairly convicted view that the concentration in the Nasdaq among a handful of stocks will eventually be the stock market’s …

Continue reading