Here is a couple of untied options trade that caught our attention in today’s trading:

Continue readingUUP

Depending on your world view, the U.S. dollar has either been range bound in the last year, with the U.S. dollar index trading between $100 on the upside and $92.50 on the downside, with the 200 day moving …

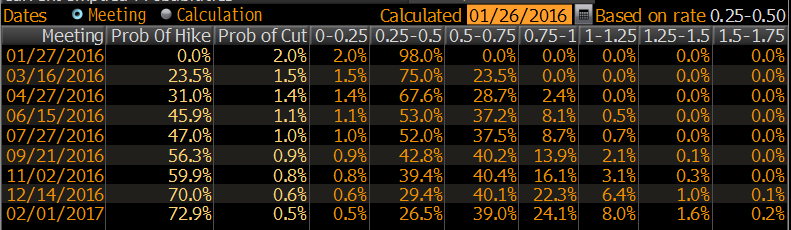

Continue readingIn late November, heading into what was a near certainty that the U.S. Fed would put an end to their zero interest rate policy in their December FOMC meeting, we decided to put on a trade that …

Continue readingWe’ve had a view for some time that despite some temporary headline driven counter trend moves here or there, the U.S. dollar will remain strong vs other currencies due to the fact that the U.S. …

Continue readingOver the past month, leading up to this morning’s ECB meeting and the FOMC’s December 16th meeting we have taken a look at the U.S. dollar on a couple of occasions. First vs the Euro (here on …

Continue readingHere is a quick recap of trades that we initiated, closed, or debated in the week that was Nov 16th to Nov 20th:

Continue readingSince the start of QE and ZIRP, Don’t fight the Fed has been one of the most profitable consensus US equity trades of the last fifty years. In the last year, the Fed has ended …

Continue readingHere is some generally directional, untied options activity that caught my eye during Wednesday’s trading: 1. SMH – the Philadelphia Semiconductor Index (SOX) absolutely got smoked yesterday, closing down 4.6%, blasting through the breakout level …

Continue readingWhile the VIX is back near its 2015 low, closing at 13.40 yesterday, volatility in global financial markets as a whole has been much higher over the past few months. Currencies and commodities have been …

Continue readingCBS – it looked like a trader closed the March 62.5 calls in CBS, 20,000+ at an average price of 94c or so. Dan pointed out some call buying back in Feb here: http://www.riskreversal.com/2015/02/12/wednesdays-notable-options-activity-cbs-dltr-nav-wmb/ I …

Continue reading