Next week the Federal Reserve will raise short term interest rates for only the second time since June 2006, and the first time this year to a range of 50 to 75 basis points. Financial …

Continue readingTreasury Yield

Market participants placed a low probability on a Trump win last month. I agreed. Markets also bet on a risk of a sell-off in stocks (stocks sold off as polls tightened, puts went bid) I …

Continue readingQ3 earnings season kicks off next week. The main event will come Friday morning with earnings from Citibank (C), JP Morgan (JPM) and Wells Fargo (WFC), three stocks that make up nearly 25% of the …

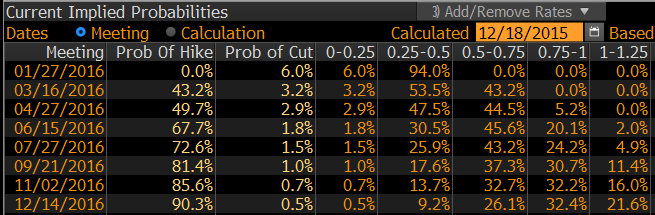

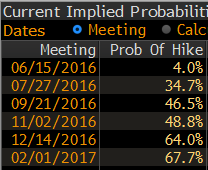

Continue readingUnless you invest from under a rock, you know that the Federal Reserve meets next week to debate interest rate policy. Fed Fund futures are currently pricing about a 20% chance that the Fed will …

Continue readingThis morning I had some thoughts on interest rates (MorningWord 9/14/16: Basket of Predictables). To recap, I don’t think they are going meaningfully higher anytime soon. Maybe we get back to 2.25% in the 10 …

Continue readingWill they? Won’t they? The financial press (and it seems the political press too) can’t stop with this. Yep, because it’s election season, everyone is playing the guessing game on a possible Fed rate hike …

Continue readingDespite mounting pressures, both internally and externally, for a divided FOMC (as evidenced by the July minutes) to raise short term interest rates for only the second time since June 2006, the yield in the …

Continue readingUntil the S&P 500 (SPX) makes a new all time high (less than 2% away), or fails in and around 2100 for the 7th time (since the all time high) in May 2015, I’ll just shut …

Continue readingUmmm, I suck. Yesterday I started my morning post (Cause I Don’t Want to Be… Anarchy) with a confession, and an apology: Confession: Not for a moment in the last couple months have I seriously considered …

Continue readingIf the May jobs data had come in hot this morning, it would have provided coverage for the U.S. Fed to pull the trigger on their second rate hike in 10 years (their first since …

Continue reading