JP Morgan reports Q4 results tomorrow before the open. The options market is implying about a 2.3% one day post earnings move, which is rich to the 4 qtr average one day post earnings move …

Continue readingTrade Idea

Event: Disney (DIS) will report fiscal Q3 results tonight after the close. The options market is implying about a 3.3% one day post earnings move which is well below the 5% four qtr one day average …

Continue readingOn January 28th Visa (V) reported fiscal Q1 results that beat expectations, and offered in-line guidance. The stock rallied 7.5% the next day. On the earnings call management suggested that the strength of the dollar …

Continue readingOn Monday I highlighted a bearish options trade in GE (here): When the stock was $28.86, a trader bought to open 30,000 of the March 26 puts for 28 cents to open ($840,000 in premium), …

Continue readingEvent: Boeing (BA) reports Q4 results tomorrow before the open. The options market is implying about a 4% one day move, which is rich to the 4 qtr average one day move of 2.5%, and …

Continue readingUnder Armour has been an astonishing growth story with great products, ballsy management, and a surging brand thanks to attractive endorsers, but the stock has been in a serious funk since its all time highs made …

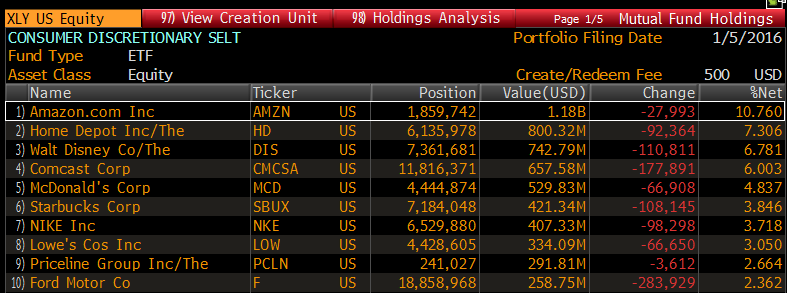

Continue readingTo state the obvious, positive returns in U.S. equity markets were hard to come by unless you were invested in a couple dozen large cap growth stocks. And from a trading perspective it was a fool’s …

Continue readingRegular readers know that commodities and their related stocks aren’t usually my focus. Despite my tourist status, I have had some views on crude oil weakness since the end of 2014. Those views have remained steadfast …

Continue readingLast week I previewed Oracle’s (ORCL) fiscal Q2 earnings report due out after the close (here). With just a few hours to the print, the options market is implying about a 5% move between now …

Continue readingThe largest single stock options trade so far today was a bearish roll in Freeport McMoran (FCX), a stock that we recently placed a contrarian bullish options trade in (read here). First I want to …

Continue reading