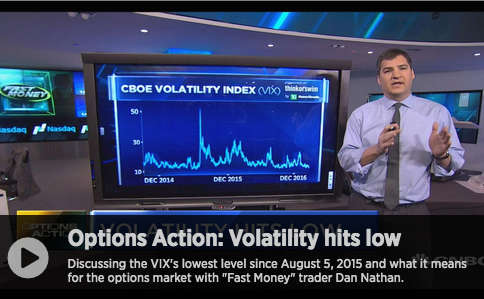

Last night on CNBC’s Fast Money they asked me to take a quick look at the VIX (CBOE Volatility Index) trading at 2016 low, briefly below 11 for the first time since Aug 5th, 2015: …

Continue readingSPY

Right out of the gate this morning it appears a trader made an outright bearish bet or possibly putting in place some near term portfolio protection in the S&P 500 etf (SPY). When the SPY …

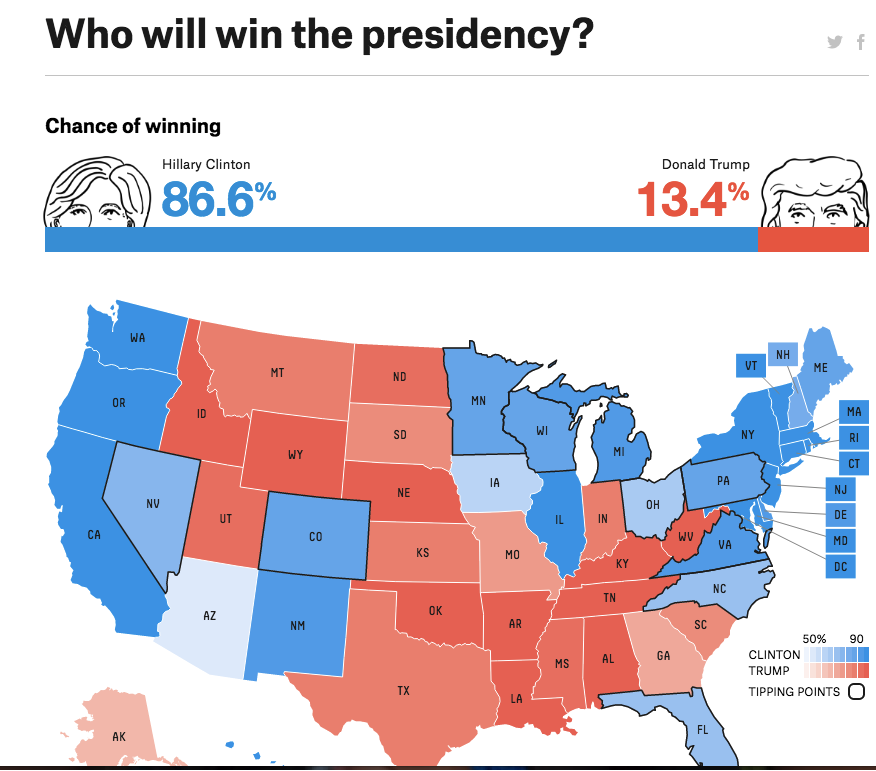

Continue readingNo matter what your political affiliation is, there is a whole heck of a lot of wtf today from citizens, investors, politicians, pollsters and the press. I think it is safe to say that few (even …

Continue readingPrior to the the UK’s Brexit vote in late June, I took a fairly apathetic view to the prospects of a Leave vote, and expected the people of the UK to vote to Remain in the …

Continue readingIn a market that had a decidedly risk-off feel today, there was some large apparently directional options trading that might have fit that theme: GDX: the etf that tracks gold miners saw heavy call volume, 2x average daily volume …

Continue readingBiotech stocks have been a disaster so far in 2016, with Nasdaq Biotech etf IBB down 20% ytd, and down 34% from its all time highs (in August 2015), and S&P Biotech etf XBI down …

Continue readingIt’s been my view for some time that on top of the very large list of risks to a fragile U.S. economic recovery (and increasingly vulnerable global financial markets) is the election of Donald Trump to be …

Continue readingThe S&P 500 (SPX) clawed back a good bit of its early 1% losses by days end. One noticeable theme in today’s trading was options traders rolling existing positions: GS: bank stocks under-performed the broad market most of the day, with …

Continue readingAs unpredictable the first half of 2016 were in financial markets, the back half is proving to be stranger. The 12% peak to trough decline in January & February caught most off-sides, and then again with the post …

Continue readingIn this weekend’s Barron’s Striking Price column, long time columnist Steve Sears, (who I am a big fan of) had Steve Sosnick of Timber Hill fill in to discuss hedging ones portfolio into the Nov 8th …

Continue reading