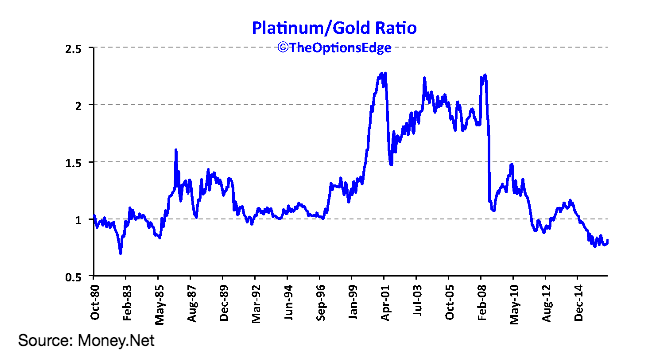

In the Precious Metals Arena, Choosy Investors Prefer Platinum Trading commodities is a very tricky endeavor on the very best of days. While one can make an attempt to interpret the supply (production, recycling, etc.) …

Continue readingRSI

Boring Can Be is Beautiful & Profitable: Assurant Inc. (AIZ) De-risked & Ready for a Repricing Assurant, Inc. (AIZ) is a niche property-casualty & risk-management insurance company that competes worldwide. One of the interesting products …

Continue readingEarlier Josh Brown blogged and tweeted about the S&P Metals and Mining (XME) ratio chart to the S&P 500 (SPX), saying: Ten years of underperformance. A long-term downtrend now being snapped, the year to date …

Continue readingBack in late July and early August we made a couple bearish trades against large cap tech stocks through QQQ puts. Despite the thesis playing out now, it was a very poorly timed. As of two …

Continue readingNothing like a couple of hacks to get investors focused on data security companies. If you haven’t been keeping abreast, news recently broke of a hack on U.S. banks, followed by the iCloud hack of …

Continue readingNearly three weeks ago, when the QQQ was $94.35, just a tad below current levels, we bought the Aug 94 puts (below) as we thought the growing divergences between the Nasdaq 100’s leadership and rank and file …

Continue readingYesterday we highlighted the extremely low levels of implied volatility in QQQ at a time where it appeared that the index was reaching fairly rare level of “overbought-ness” (see below). Today’s price action, a continuation from …

Continue readingThe Nasdaq has become very overbought over the past couple of weeks, though, as has been usual at various times over the past several years, many underlying divergences persist. Tom McClellan noted one such divergence …

Continue readingAAPL is trading only 7% from a new all-time high, quite a ride compared to a year ago. AAPL is now up 17.5% in 2014, one of the major leaders for the overall market indices. …

Continue readingVIX spot is approaching the 10 level, which it has only touched on a few occasions over the past 10 years (and really, since the inception of the index): The main difference between the 2004 …

Continue reading