Back on October 10th we looked at Procter & Gamble and express eda bearish view with a December put butterfly targeting the 82.50 area. Here was the trade: *PG (89.25) Buy the Dec 90/82.5/75 put …

Continue readingPG

On October 10th we looked at Procter & Gamble (PG), very near 52 week highs, considering the recent rise in the U.S. dollar and Treasury yields into an increasingly likely rate increase at the FOMC’s Dec …

Continue readingThe bond market is closed today for Columbus Day, but the TLT (iShares 20 year Treasury bond etf) is down a little less than 1%, suggesting that yields would be up a bit. The etf …

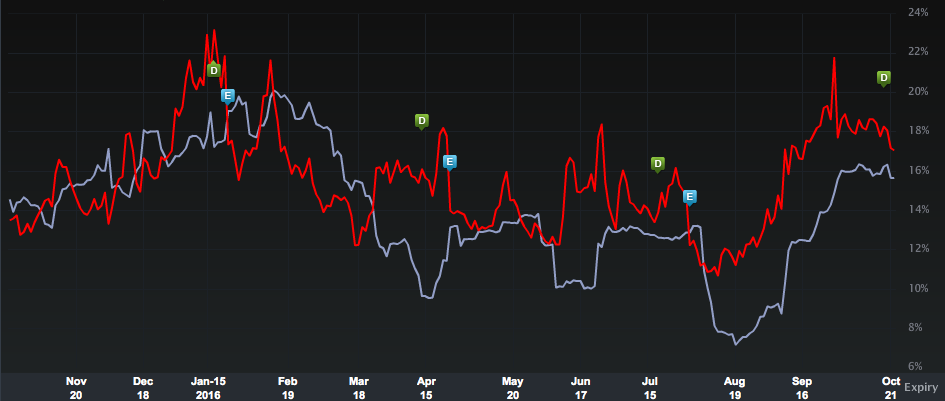

Continue readingEarlier, Dan posted a thorough preview of Procter & Gamble’s Q4 earnings due tomorrow morning. Implied vol in the name has creeped up into the event but is still way below levels seen over the …

Continue readingEvent: Procter & Gamble (PG) report fiscal Q4 results tomorrow before the opening bell. The options market is implying about a 2.5% one day post earnings move vs its 4 quarter one day average move …

Continue readingBack on June 17th I made a bearish near term case for shares of Proctor & Gamble (PG), highlighting stretched valuation, unusually high investor sentiment despite dollar headwinds and impediments to growth in key overseas …

Continue readingSince the start of 2014, shares of Proctor & Gamble (PG) are essentially unchanged, up $2, or about 2.5%, vs the S&P 500 (SPX) up about 13% during the same period. The dividend yield on the …

Continue readingMicrosoft (MSFT) has enjoyed a bit of a resurgence from a relevance standpoint since Satya Nadella took the CEO helm after formerly heading the company’s cloud business. The new found focus of Nadella on innovation …

Continue readingWhen Proctor & Gamble (PG) reports their fiscal Q4 results in early August the company will likely print an eps decline of 10% for fiscal year 2016 with a 15% sales decline. The expected $65 …

Continue readingU.S. consumer staples stocks (XLP) are the second best performing sector in the S&P 500 (SPX) in 2016, up 5.5%, behind Utilities (XLU) which are up 13%. Despite mildly under-performing the SPX’s 200% gains from the …

Continue reading