Buying the dip in a market like this comes with some high risk but also the potential for high reward, especially in single stock names. We highlighted two such names the past few days Recently …

Continue readingMarch Expiration

Event: Palo Alto (PANW) reports their fiscal Q2 results tonight after the close. The options market is implying about a 10% one day move, which is rich to the 4 quarter average of about 5%. …

Continue readingThe Nasdaq 100 (QQQ) had been a pretty boring trading vehicle for a while, as some of its large components had been in a fairly complacent upward trajectory for what felt like years. But then …

Continue reading6Last night on CNBC’s Fast Money my friend Carter Worth of Cornerstone Macro Research laid out his technical view on the S&P 500 (SPX). He has been consistent for months, if not quarters that the …

Continue readingEvent: Tesla (TSLA) reports Q4 results tonight after the close. The options market is implying about a 15% one day move which is rich to the 4 qtr avg of about 7% and the long the …

Continue readingEvent: Twitter will report their Q4 results tonight after the close. The options market is implying a whopping 17% one day move, which is rich to the average of about 14% one day move following …

Continue readingYesterday I did a short preview on Disney’s fiscal Q1 results due out after the close: Event: Disney (DIS) will report fiscal Q1 results tonight after the close. The options market is implying about a …

Continue readingOne of the worst things you can do in trading a declining market from the short side is targeting a stock that you think is overdue for a substantial pullback but only getting a small …

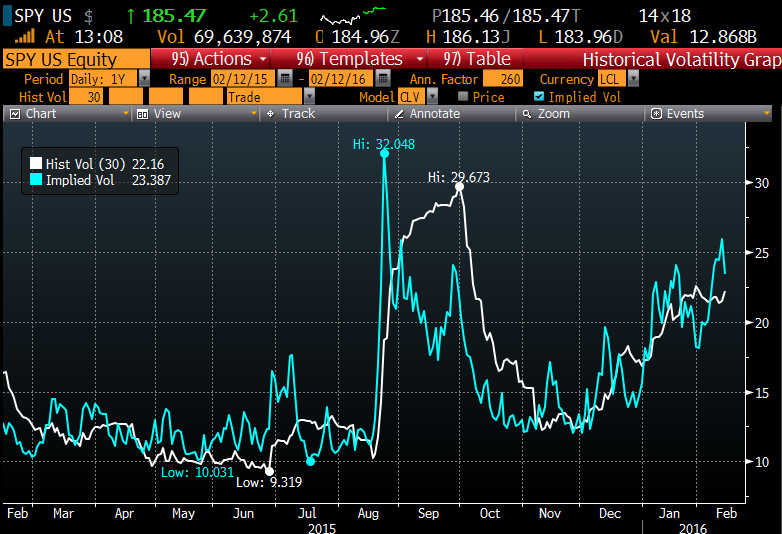

Continue readingRegular readers know that I have been less than optimistic about the return environment for equities globally with the end of QE in late 2014, and the end of ZIRP this past December. I know …

Continue readingWhat’s likely to be the largest trade in the options pits today was a bullish roll in the SPDR Gold etf (GLD). When the etf was $107, a trader sold to close 27,000 of the …

Continue reading