Yesterday I discussed the sector rotation since the presidential election results on Nov 9th: I sincerely have no idea whether the rotation out of growth stocks, primarily Tech, and “yield-ers”… Consumer Staples, Telco and Utilities, …

Continue readingJNJ

Here was some large possibly directional options trades that caught my eye in today’s trading: GM: Shares of General Motors are having one of their worst days in months, down 4.25% following Q3 results that …

Continue readingIn 2015 the energy sector, measured by the S&P Energy Select etf (XLE) was the worst performing group, down 22%. In 2016, the XLE is the best performing group, up nearly 20%. As we barrel into year end, …

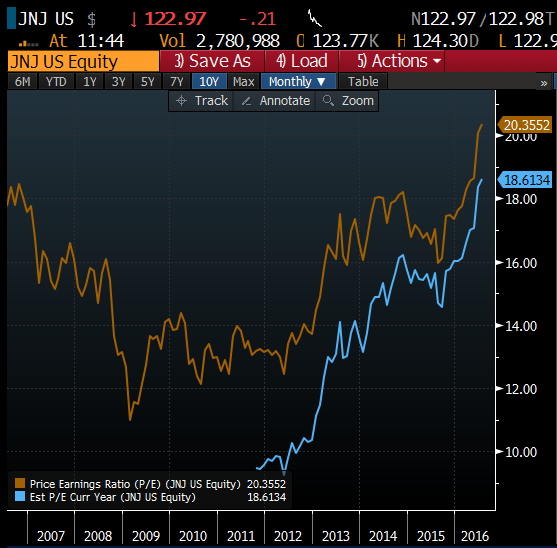

Continue readingThis may be getting old by now, asking yourself questions like why does Johnson & Johnson (JNJ) trade at 18x expected 2016 eps? Yeah defensive (medtech, pharma & shampoo) with that buyback and 2.66% dividend yield, …

Continue readingI know why investors have been flocking to stocks like Johnson & Johnson (JNJ), the defensive nature of the products that they sell, massive commitment to cash return (existing $10 billion share repurchase) and current …

Continue readingFor week’s now my co-panelist on CNBC’s Options Action, Carter Worth of Cornerstone Macro Research has been making the bullish case for the Biotech stocks, specifically looking at the IBB, the iShares Nasdaq Biotech etf. …

Continue readingAs I write the S&P 500 (SPX) is unchanged after yesterday’s 2.5% surge, not bad action, especially when you consider how many market participants have been eyeing a series of closes above 1950, to possibly …

Continue readingOn Wednesday we laid out a bearish trade idea in the IBB, the iShares Nasdaq Biotech etf (read here) largely as a result of a poor technical set up, poor relative performance to other market …

Continue readingEvent: Johnson & Johnson (JNJ) reports Q2 results tomorrow before the open. The options market is implying about a 1.8% earnings move, with the stock at $100 the July 100 straddle is offered at about …

Continue readingJohnson & Johnson (JNJ) reports Q1 results tomorrow before the open. The options market is implying about a 2% move. The April 17th 101 straddle (the call and the put premium) is offered at about …

Continue reading