Remember when Chinese equities (Shanghai Composite) inflated 180% from their June 2013 lows to their June 2015 highs: Then the index got cut in half. It put in lows earlier this year, before regaining some …

Continue readingJan Feb

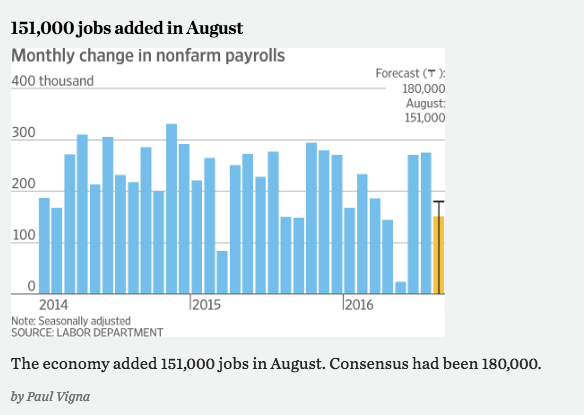

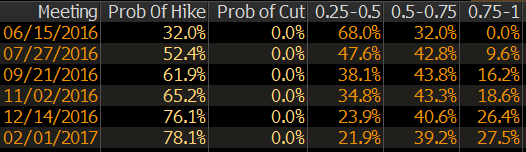

In case you missed it before your holiday weekend sign-off, the August non-farm payrolls came in below expectations at 151,000 jobs added (vs 180,000 consensus), well below the 2016 average of 182,000 and well below the …

Continue readingI wanted to highlight a few interesting reads from the last couple days. I think these are fairly important for U.S. investors looking at the relative strength of U.S. stocks and the yield differential between our …

Continue readingContext matters in most things in life. While the nearly 95% bounce in oil from the February lows might be explained by an uptick in demand, or a decrease in supply, the reality is it has had little to do …

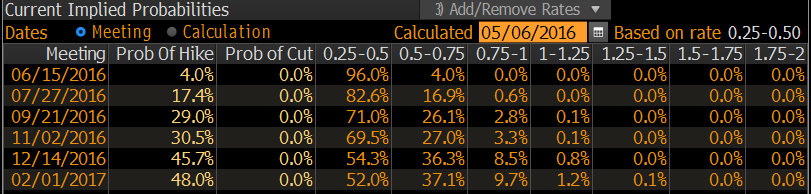

Continue readingIn case you missed it, the Fed speak over the last week, and the Minutes of the the FOMC’s April meeting put to be bed the debate whether or not their June FOMC get together is a “live” …

Continue readingEarlier, we posted an update our existing XRT trader (here), but since I’ll be discussing this trade on CNBC’s Options Action tonight I want to have a separate post isolating the new strikes without the profits …

Continue readingWhile about 70% of S&P 500 companies having reported Q1 earnings, the balance of high profile names yet to report will be heavily dominated by retailers like Costco (COST), The Home Depot (HD), Lowe’s (LOW), …

Continue readingApril non-farm payrolls came in 45k below the 205k expectations, with a revision lower for February and March. April’s print was the lowest since September 2015, and the 2016 average of 192k per month is …

Continue readingWith earnings season comes idiosyncratic single stock risk. We all know that and in many ways its one of the very things that attracts us to trading individual stocks vs etfs. But what can be …

Continue readingLet’s power through this together. For the last couple months I have been of the belief that no matter how far we bounced off of the February lows, the eventual failure will likely be below the …

Continue reading