Here is some apparently untied directional options activity that caught my eye in today’s trading: XRT: the S&P retail etf is down about 10% from its August highs, one of the worst performing S&P sectors …

Continue readingHYG

Here was some (apparently) untied directional options trades that caught my eye in today’s trading: BABA: the Chinese eCommerce giant Alibaba apparently has a date with its prior all time high near $120 (from late …

Continue readingHere is some decent size apparently directional options trades in sector etfs that caught my eye in today’s trading: XLF – rate sensitive stocks are getting nailed today despite the 10 year yield trading at the …

Continue readingTowards the end of July we took a look at the HYG, the iShares high yield corporate bond etf. At the time, HYG had been in a very tight consolidation around $86. Here was the …

Continue readingIn the last month and change we’ve focused some short delta ideas that have some similar themes (e.g. increased chances of recession Europe post Brexit). We expressed those views in 3 etfs in particular that …

Continue readingHaving just broken out to new all time highs, the S&P 500 (SPX) is up 6.25% on the year, and up 20% from its 2016 lows at 1810, made on February 11th. It’ now 6.5% …

Continue readingOur post Brexit investment world feels a lot like the downdraft we saw in early 2016 with currencies and credit showing strains, and the most severe downward pressure on equities and commodities. The options activity in …

Continue readingContext matters in most things in life. While the nearly 95% bounce in oil from the February lows might be explained by an uptick in demand, or a decrease in supply, the reality is it has had little to do …

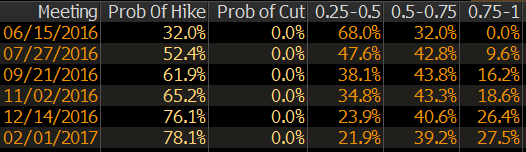

Continue readingIn case you missed it, the Fed speak over the last week, and the Minutes of the the FOMC’s April meeting put to be bed the debate whether or not their June FOMC get together is a “live” …

Continue readingThis morning in the WSJ’s Streetwise column, James McKintosh succinctly summed up the bi-polar behavior of investors in risk assets over the last last couple months (The Markets Have a Message: Don’t Believe This Rally): Worries …

Continue reading