Bank stocks have been one of our focuses in the New Year. It was our view that into their earnings, sentiment had gotten so good that a continuation of the bullish run would be difficult …

Continue readingGoldman Sachs

Shares of Goldman Sachs are up nearly 35% on the year, most of it since Nov 8th, and up nearly 75% from its late June post Brexit lows, and now just 3% from its all …

Continue readingRegular readers know we don’t place too strong of emphasis on unusual options activity. Without intimate knowledge of the trade, or knowing the initiators’ intent, whether the trade is outright, or delta neutral, or what …

Continue readingEvent: Apple (AAPL) reports their fiscal Q4 results tonight after the close. The options market is implying about a 4% move in either direction, which is shy to the average of 5.85% over the last …

Continue readingBeing wrong about the direction of a stock, or a market is part of this business. What I have found in my nearly two decades trading in financial markets is that embracing the fact that …

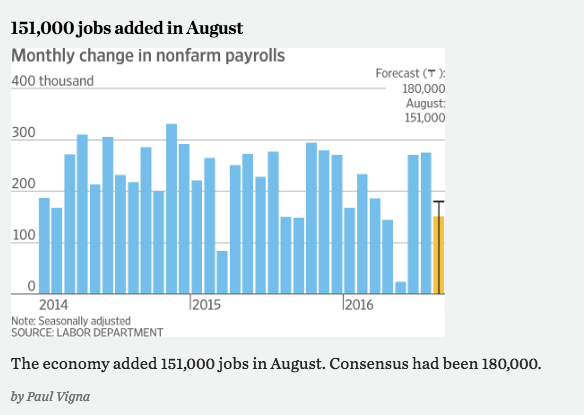

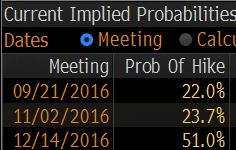

Continue readingIn case you missed it before your holiday weekend sign-off, the August non-farm payrolls came in below expectations at 151,000 jobs added (vs 180,000 consensus), well below the 2016 average of 182,000 and well below the …

Continue readingAt 2pm this afternoon the Federal Reserve will release the Minutes from their July FOMC meeting. Mohamed El-Erian, Chief Economic Adviser to Allianz, had an insightful preview this morning for Bloomberg View (here). El-Erian concluded his list of what to …

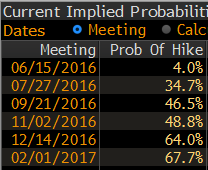

Continue readingIf the May jobs data had come in hot this morning, it would have provided coverage for the U.S. Fed to pull the trigger on their second rate hike in 10 years (their first since …

Continue readingLast month, the Fed floated a June raise trial balloon. On May 16th, expectations for a June hike sat at a 4% probability. After the trial balloon they shot up to a 34% chance by May …

Continue readingIn this past weekend’s Barron’s, The Striking Price author Steve Sears, highlighted Goldman Sachs’ fundamental and derivative research on Boeing (BA) in front of the company’s annual analyst day this Wednesday (Goldman Gloomy on Boeing Outlook). …

Continue reading