A couple weeks ago we highlighted the poor relative year to date performance of shares of General Electric (GE) to many of its peers in the industrial space and the broad market, up only 2%: vs …

Continue readingGE

Shares of General Electric (GE) have spent the better part of 2016 trading in a fairly tight range between $28 and $32, now approaching the upper end: To my eye, a rejection at $32 and …

Continue readingLast Friday we detailed a couple set ups in two mega-cap down stocks that report tomorrow before the open, General Electric (GE – Choose Your Own Adventure) and McDonalds (MCD – Making A Meal Out Of It), …

Continue readingGeneral Electric (GE) is scheduled to report Q3 results Friday morning, Oct 21st before the open. The options market is currently implying a 2% one day move which is a tad rich to its 4 qtr …

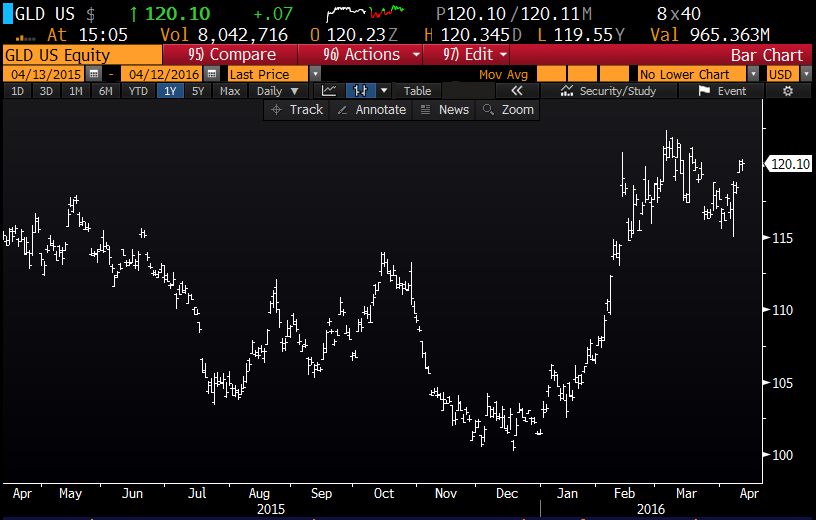

Continue readingOn Monday in this space we highlighted some upside call buying in the gold etf GLD (here). The buying was concentrated in September quarterly expiration and was playing for a move back towards $140. Today …

Continue readingHere are a few long premium directional options trades that caught my eye in today’s trading: GLD – since the Gold’s ramp off of 52 week lows in mid December to new 52 week highs …

Continue readingEarlier in the week Bernstein’s industrial analyst Steve Winoker downgraded shares of General Electric (GE) from a buy to hold, largely on valuation. Listen to his explanation of the call to CNBC’s Carl Quintanilla from …

Continue readingThe emerging market etf, EEM takes the prize for the single largest options trade in the market today. When EEM was trading $30.50, there was a buyer of 215,000 of the March 33 calls, paying …

Continue readingOn Monday I highlighted a bearish options trade in GE (here): When the stock was $28.86, a trader bought to open 30,000 of the March 26 puts for 28 cents to open ($840,000 in premium), …

Continue readingShortly after the open there was a bearish options trade in shares of General Electric (GE) that caught my eye, not specifically because of the premium outlay, but because of the commitment to purchasing puts in …

Continue reading