Norfolk Southern Corp (NSC): Too Far Too Fast? Norfolk Southern Corporation (NSC) is a major U.S. railroad company servicing the area east of Iowa and Kansas. The company owns about 15,000 miles of track and …

Continue readingGDP

I read this on the social media, so it has to be either true… or fake: The S&P 500, Dow, Nasdaq Composite and Russell 2000 all closed at records today. Last time that happened was Dec. …

Continue readingEarlier Josh Brown blogged and tweeted about the S&P Metals and Mining (XME) ratio chart to the S&P 500 (SPX), saying: Ten years of underperformance. A long-term downtrend now being snapped, the year to date …

Continue readingFriday’s GDP print of 1.2% for the 2nd quarter places the average for the first half at 1%, which as I highlighted yesterday (here), if not revised higher would be the weakest start to a …

Continue readingI wanted to highlight a few interesting reads from the last couple days. I think these are fairly important for U.S. investors looking at the relative strength of U.S. stocks and the yield differential between our …

Continue readingThis morning the Atlanta Fed’s GDPNow tracker, which shows a meaningful uptick in Q2 activity is making the rounds: On May 13, the #GDPNow model forecast for real GDP growth in Q22016 is 2.8% https://t.co/FMxeZy8vKJ pic.twitter.com/tMm2HJfS4B …

Continue readingYou know the old saying, Credit leads Equities. And in China, the country’s fairly well documented credit bubble is leading their stock market down a long road to ruin. The Shanghai Composite closed down 2.8% overnight, …

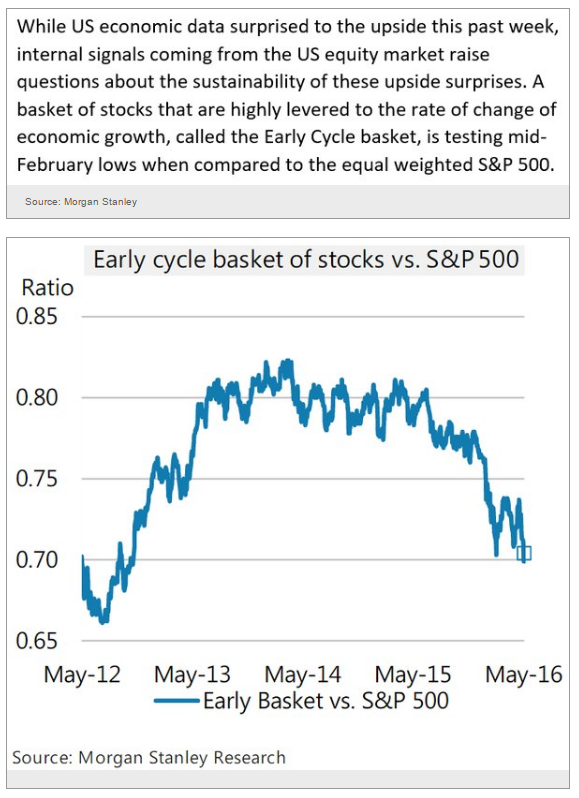

Continue readingThis morning in the WSJ’s Streetwise column, James McKintosh succinctly summed up the bi-polar behavior of investors in risk assets over the last last couple months (The Markets Have a Message: Don’t Believe This Rally): Worries …

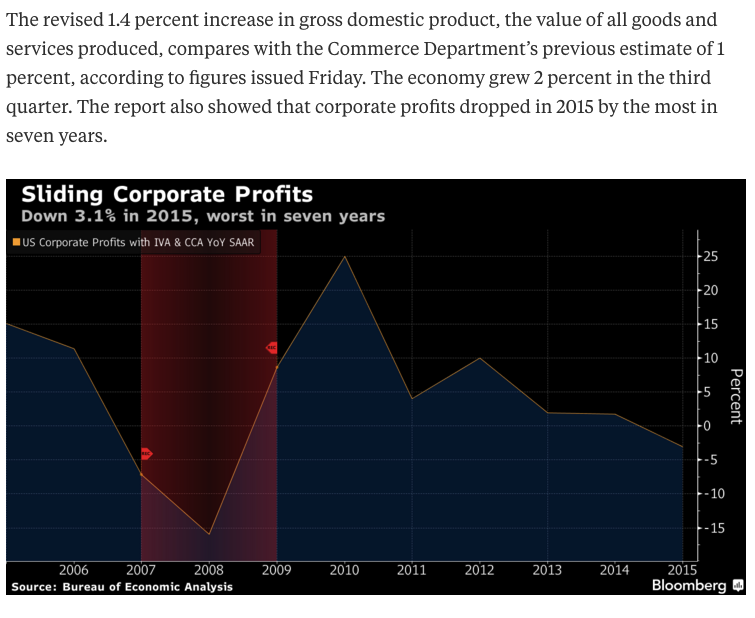

Continue readingIn case you missed it, on Friday, Q4 2015 GDP was revised, per Bloomberg: Another Bloomberg story, dissecting the Q4 GDP, lays out a concern: Yet beyond the headline number, there is a reason for some …

Continue readingReminder: I’ll be a panelist on the latest Ticker District webinar this evening, at 8pm If you haven’t already register here: Webinar Preview: As we head into a potentially volatile period with three major central …

Continue reading