On December 2nd we looked at a way to buy a very low VIX with eyes towards today’s FOMC release. The meeting has come and gone and the market is selling off a bit in …

Continue readingFOMC

The FOMC meets on Dec 13th and 14th with an announcement of their first rate hike in a year expected on the afternoon of the 14th. Odds of a .25 rate hike at the meeting …

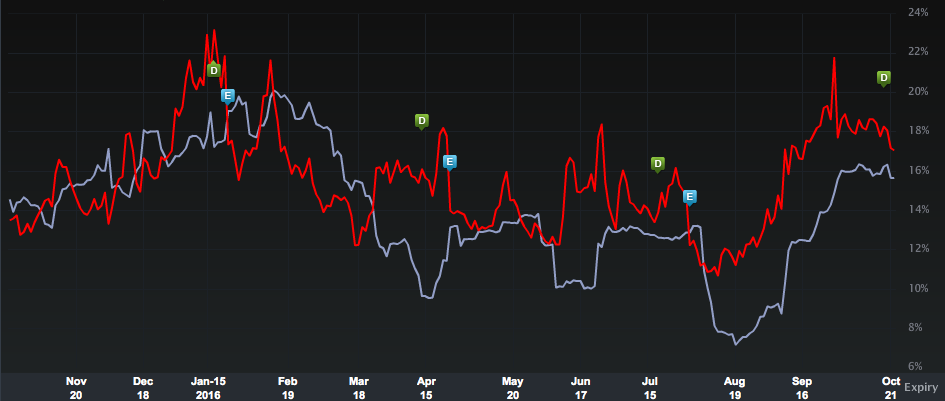

Continue readingThe VIX (CBOE Volatility index) recently touched the fairly low level of 13 on October 24th. Since that day, it has seen seven straight up days and is now above 20 on today’s nearly 20% …

Continue readingBack in September we looked at the near term prospects for higher bond yields after U.S. Treasuries had just come off of historic lows and the likelihood that at least one rate increase by the FOMC …

Continue readingOn October 10th we looked at Procter & Gamble (PG), very near 52 week highs, considering the recent rise in the U.S. dollar and Treasury yields into an increasingly likely rate increase at the FOMC’s Dec …

Continue readingLast night on CNBC’s Fast Money my co-panelist Pete Najarian offered his final trade, that he is long and strong Bank of America (BAC), and thinks it makes a new 52 week high above $18 …

Continue readingEvent: Citigroup (C) is scheduled to report its Q3 results Friday before the open. The options market is implying about a 3% one day move in either direction, which is a tad higher than the …

Continue readingExpectations for a Fed Funds rate increase at the November 2nd FOMC meeting aren’t particularity high at only about a 19%. For all intents and purposes, this might as well be zero, especially just 6 days …

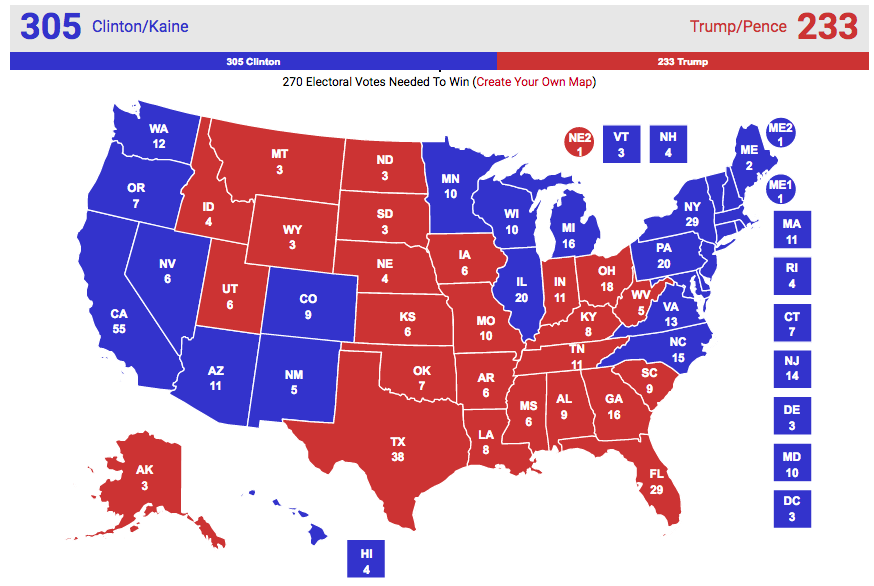

Continue readingAs unpredictable the first half of 2016 were in financial markets, the back half is proving to be stranger. The 12% peak to trough decline in January & February caught most off-sides, and then again with the post …

Continue readingYesterday’s price action across most major risk asset classes was a clear indication that investors are re-positioning for rate tightening cycle. Let’s quickly refresh The S&P 500 (SPX) was down 0.5%, the yield on the …

Continue reading