In the days following the U.S. election in early November, investors got it in their head almost immediately that the outcome didn’t mean some newfound economic populism and trade wars, but traditional Republican supply side …

Continue readingFederal Reserve

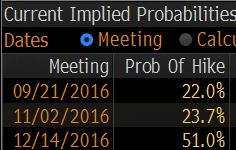

Next week the Federal Reserve will raise short term interest rates for only the second time since June 2006, and the first time this year to a range of 50 to 75 basis points. Financial …

Continue readingThe nearly 2% decline for the S&P 500 (SPX) in October was its first monthly decline since February (down 41 bps) and worst since January’s 5% decline. I have no idea if the SPX is merely consolidating above …

Continue readingThree weeks ago we made the case that before this market rally is all said and done, there is a very strong likelihood that shares of Microsoft (MSFT) will make a new all time high: …

Continue readingTwo weeks ago on August 24th we took a look at GDX, the Vaneck Vectors Gold Miners etf, on one of its worst down days it had seen in months. We laid out a scenario where …

Continue readingBeing wrong about the direction of a stock, or a market is part of this business. What I have found in my nearly two decades trading in financial markets is that embracing the fact that …

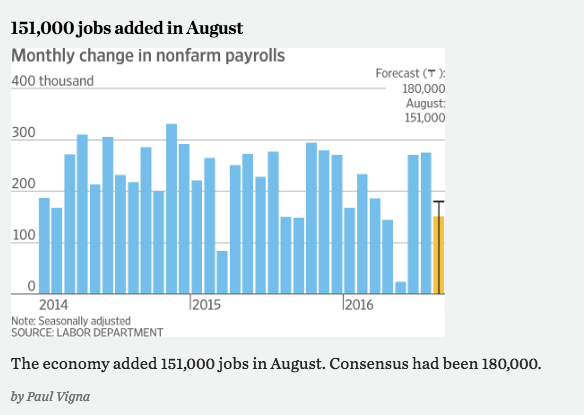

Continue readingIn case you missed it before your holiday weekend sign-off, the August non-farm payrolls came in below expectations at 151,000 jobs added (vs 180,000 consensus), well below the 2016 average of 182,000 and well below the …

Continue readingAt 2pm this afternoon the Federal Reserve will release the Minutes from their July FOMC meeting. Mohamed El-Erian, Chief Economic Adviser to Allianz, had an insightful preview this morning for Bloomberg View (here). El-Erian concluded his list of what to …

Continue readingNew all time highs in the S&P 500 (SPX) and the Dow Jones Industrial Average (INDU) have done the financial world the pleasure of anointing a whole new generation of market wizards. Myself? I have …

Continue readingLeader of the U.K. Independence Party and guy who led the charge for the Leave vote, Nigel Farage, took his Muppet Show on the road to EU headquarters in Brussels yesterday. Farage agreed to an …

Continue reading