Remember when Chinese equities (Shanghai Composite) inflated 180% from their June 2013 lows to their June 2015 highs: Then the index got cut in half. It put in lows earlier this year, before regaining some …

Continue readingFeb Expiration

Until this week’s 5% rally (back up on the year ~3.5%) in shares of Alphabet (GOOGL) the stock, along with many other mega-cap stocks have largely sat out the post election rally in U.S. stocks, …

Continue readingPrior to Facebook’s (FB) Q4 results on Jan 27th, we detailed a bearish put butterfly in February expiration that we considered as an outright bearish trade, or thought fairly suitable for near the money protection …

Continue readingThis morning we previewed Apple’s (AAPL) earnings due after the bell today. Do read the whole thing, but for now, here were some closing thoughts: So for now, I suspect that at current levels a Q1 …

Continue readingIt was a pretty volatile week for most risk assets the world over. At one point here in the U.S. and Europe on Wednesday it felt as though we were nearing a crash. Things have …

Continue readingLast week (below) I made the case why Verizon (VZ), despite the wireless data pricing headwinds it faces, could be an attractive place to park some cash. The thought is based on the stock’s 5% …

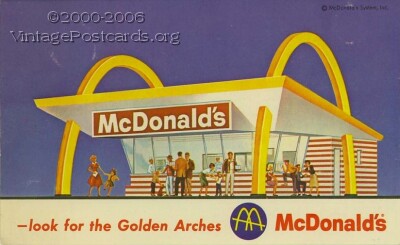

Continue readingOn Friday’s Option’s Action on CNBC, my co-panelist Carter Worth made a fairly compelling case why shares of McDonald’s (MCD), one of the best performing stocks in the Dow Jones Industrial Average in 2015 could …

Continue readingFor months now it has been our view that the Russell 2000’s weak relative performance has made the etf on the small cap index, the IWM, one of the best equity portfolio hedging vehicles, at …

Continue readingIf the 3% decline in the US Dollar vs the Euro yesterday demonstrated anything to investors, it’s that when consensus, crowded trades unwind, they do so in a violent fashion. There have been few consensus trades in 2015 …

Continue readingShares of MSFT are up an astounding 11% today, breaking out to new 15 year highs. The chart now shows little overhead resistance until its prior all time high just below $60 back in 1999: …

Continue reading