Regular readers of RiskReversal, viewers of CNBC’s Fast Money & Options Action and my followers on Twitter are likely familiar with two of my adamant leanings in 2016, one having to do with the election and …

Continue readingFast Money

In mid July, semiconductors as a group had a major technical breakout, with the SMH (the etf that tracks 25 semi stocks, Intel and Taiwan Semi making up about 30% of the weight) blowing through …

Continue readingWe’re not getting to hear much policy discussion in this strange presidential election cycle but one topic that sometimes gets through is healthcare. A hot button issue over the past year on the Democratic presidential …

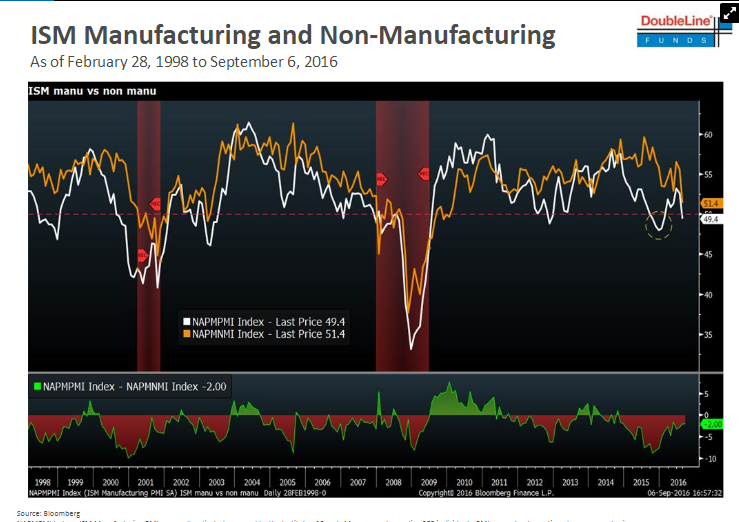

Continue readingOn CNBC’s Fast Money last night we had the pleasure of getting DoubleLine Capital’s Jeffrey Gundlach’s response to the Federal Reserve’s policy statement (or non-statement): On Friday, I detailed some of Gundlach’s recent commentary from …

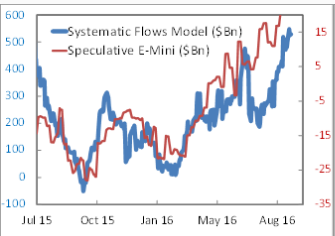

Continue readingEarlier, Dan reiterated a point we’ve been making here on the site, in that vol is historically cheap, based on historically low actual volatility through July and August. As JP Morgan’s Marko Kolanovic pointed out …

Continue readingLast night on CNBC’s Fast Money, Marko Kolanovic, JPMorgan’s global head of derivative strategy made the case for an uptick in volatility, and the strong potential for a pullback in U.S. stocks nearing 5% between now …

Continue readingLast night Salesforce.com (CRM) reported fiscal Q2 results that were generally inline. They guided the current quarter down a touch, and left full year guidance intact. The stock was down 8% last night in the …

Continue readingYesterday, shares of Fitbit (FIT) closed up 13.5%. Shares of 3D Systems (DDD) closed up 17.5%. This morning, shares of Square (SQ) opened up 15%. All of these initially hot out of the box (IPO) tech stocks are …

Continue readingAs a part time financial markets pundit and an active market participant I spend a lot of time analyzing stocks and markets in the public eye. While uncertainty is the norm when it comes to …

Continue readingEvent: Qualcomm (QCOM) reports fiscal Q3 results tonight after the close. The options market is implying a 4.5% one day post earnings move which is shy of the 7% average over the last 4 quarters …

Continue reading