I sincerely have no idea whether the rotation out of growth stocks, primarily Tech, and “yield-ers”… Consumer Staples, Telco and Utilities, into Banks, Industrials, Materials and Oil stocks is healthy with the broad market at all …

Continue readingFANG

If you haven’t noticed by my sour disposition for the better part of 2016, there were a lot of things that I really hated this year. Yeah the Pokemon Go craze and Mannequin challenge were …

Continue readingFor the better part of 2015, it was somewhat concerning that a handful of growth stocks masked a total lack of progress in the broad market. #FANG 2015 vs. YTD 2016$FB +34% vs. +20%$AMZN +118% …

Continue readingAfter this post I am going to sign off for the rest of the day and I won’t be doing TV tonight. I am going upstate to pick up my girls from camp, and then …

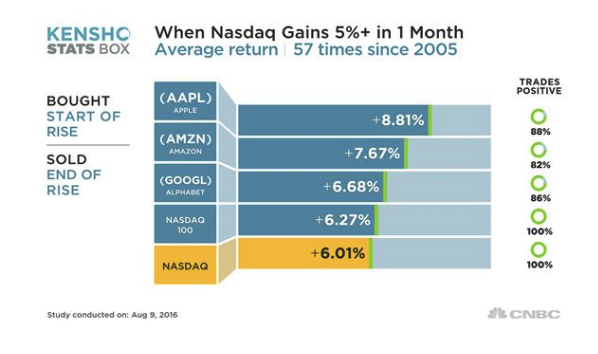

Continue readingLast night on CNBC’s Fast Money we had on JP Morgan’s Global Head of Derivative & Quantitative Strategies, Marko Kolanovic, to talk about large cap internet stocks. He thinks there is a bubble that is beginning …

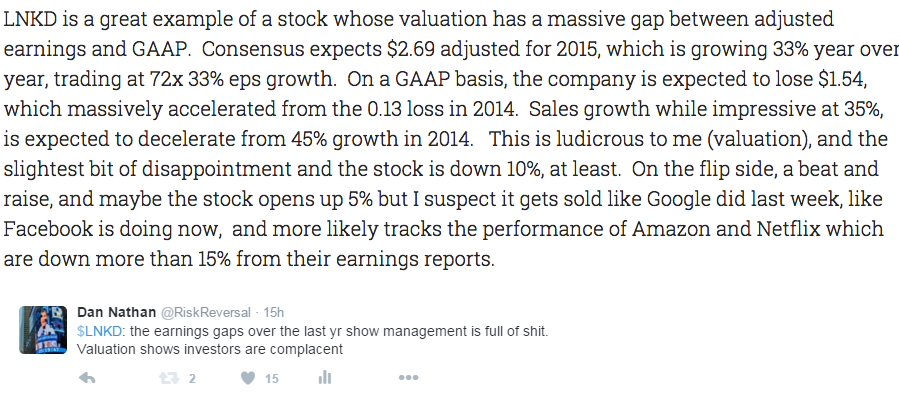

Continue readingLast night after the close, LinkedIn (LNKD) reported Q4 results that were better than expected, but guided down their outlook for the current quarter and 2016, shares are down 30% in the pre-market. My initial …

Continue readingRegular readers know that I have been less than optimistic about the return environment for equities globally with the end of QE in late 2014, and the end of ZIRP this past December. I know …

Continue readingFacebook’s (FB) 15% gain yesterday, equaling about $45 billion in market capitalization in one fell swoop, makes sense on one level because they were undeniably a fantastic set of results. But they are surprising against …

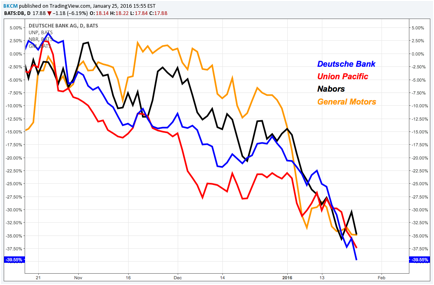

Continue readingNo He didn’t. My buddy Brian Kelly put it out there for you this morning on The Ticker District: Introducing the D.U.N.G. Stocks Deutsche Bank, Union Pacific, Nabors, and General Motors. Street Cred: Represent an …

Continue readingIn case you missed it, there’s a hip new acronym FANG, grouping four U.S. tech stocks that make up $1 trillion in market capitalization: Facebook (FB), Amazon (AMZN), Netflix (NFLX) and the newly renamed Alphabet (GOOGL). These …

Continue reading