The following segment from yesterday CNBC’s Halftime Report nicely frames the disparity of thought relating to the health of financial markets and the global economy amongst the “smart money”: Montage of Fink, Miller & Blankfein is pure comedy …

Continue readingEurope

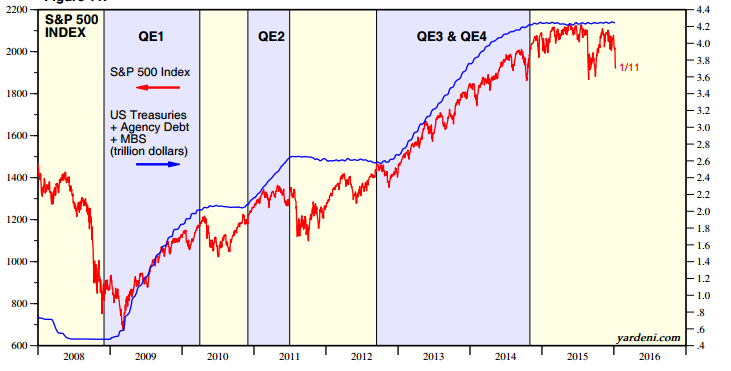

Regular readers know that I have been less than optimistic about the return environment for equities globally with the end of QE in late 2014, and the end of ZIRP this past December. I know …

Continue readingEvery correction in U.S. stocks since the end of QE1 in early 2010 has been a fantastic buying opportunity. Yesterday, Ed Yardeni posted a series of charts detailing numerous factors that have been impacted by …

Continue readingEvent: Nike (NKE) reports fiscal Q2 results Tuesday Dec 22nd after the close. The options market is implying about a 4.25% one day move following results, which is shy of the 4.8% average after the …

Continue readingConcern over the state of the high yield debt markets have been brought to the fore of late as the crash in commodity prices of the last year and half as caused some major stress in …

Continue readingI think it’s fair to say that most of the volatility (up and down) in global equity markets over the last twenty years has resulted from investment bubbles created, fueled and then mismanaged by easy monetary policies. That …

Continue readingToday we got less than expected easing from the ECB that triggered a massive risk off sell off in Europe, while on this side of the Atlantic the Fed Chair continues to make the case …

Continue readingThe downward volatility we’ve seen in the last year or so in emerging market equity and debt, precious metals, industrial commodities and finally us equities and bond yields has typically been blamed on weak demand …

Continue readingOn November 6th we placed a defined risk bearish trade in the emerging markets etf EEM. Here were our thoughts at the time and the trade: If you are of the mindset that the fear …

Continue readingThere is no denying, U.S. auto sales have been off the charts, with Sept sales reported last week the highest monthly total since 2012, and Ford (F) in particular posting a massive monthly increase: Ford’s …

Continue reading