On August 16th we positioned for a pullback in emerging market stocks after its 36% rally from its 2016 lows. Our thought process at the time was to sell near term puts in order to …

Continue readingEEM

In a market that had a decidedly risk-off feel today, there was some large apparently directional options trading that might have fit that theme: GDX: the etf that tracks gold miners saw heavy call volume, 2x average daily volume …

Continue readingThe other day we updated a position in the emerging market etf EEM. I got a good question in our QnA section on that roll as far as why we did it and why we …

Continue readingOn August 16th we initiated a bearish position in EEM, the emerging markets etf. The trade we landed on looked to fade the lack of volatility into Labor Day weekend in order to finance November …

Continue readingIn an earlier post I stated that “I am not an economist, so I’ll save you the mumbo jumbo“. Well, I am also not a technician, but I like looking at charts. One of the …

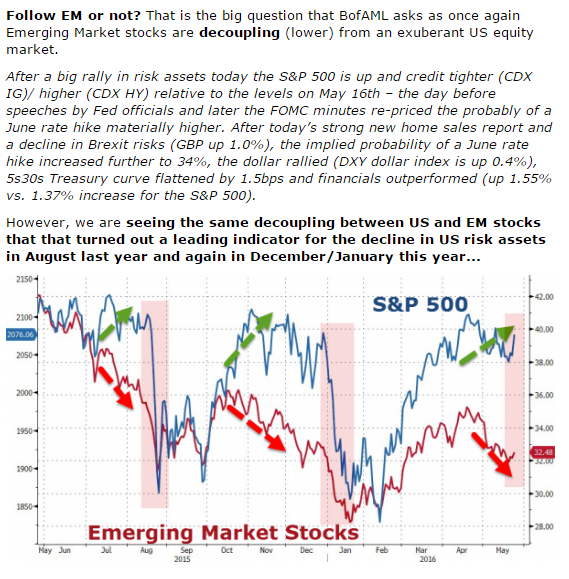

Continue readingYesterday, Zerohedge made an interesting observation (via Bank Of America Merrill Lynch) of the decoupling taking place between emerging market stocks and the S&P 500 (SPX). That was also the case prior to the two sharp …

Continue readingHere were a few decent size long premium directional options trades in index ETFs that caught my eye in today’s trading: EEM – there were a couple bullish longer dated trades in the emerging market etf. …

Continue readingAside from the insanity in left for dead, highly levered energy, materials and mining related stocks, emerging market equities were the big winners of the recent bounce in oil, stabilization in high yield credit and the range …

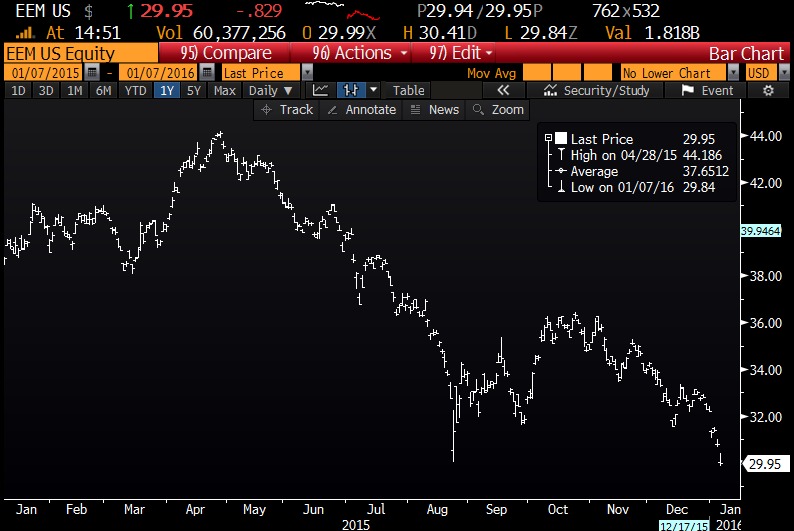

Continue readingThe emerging market etf, EEM takes the prize for the single largest options trade in the market today. When EEM was trading $30.50, there was a buyer of 215,000 of the March 33 calls, paying …

Continue readingTo state the obvious, downward volatility in Chinese stocks and their currency is at the core of of the S&P 500’s (SPX) year to date decline of 5%. And related to that, for most days this week …

Continue reading