Everyone and their mother is going to opine on the jobs data this morning, so I might as well offer my quick thoughts. We will have some more action oriented stuff later. Ok, here I …

Continue readingECB

NOTE: Last night on our sister site, Ticker District contributor Peter Boockvar, Chief Market Analyst for The Lindsey Group, and the Co-CIO of Bookmark Advisors fielded questions from the other contributors, ranging from what kind of volatility we can expect …

Continue readingFor the better part of the last 6 months, investors have been fairly clueless as to where to park cash with the prospects of a reasonable risk adjusted return. The global volatility in credit, currencies, commodities …

Continue readingLast night on CNBC’s Fast Money Carter Worth of Cornerstone Research laid out the case for buying the “Dogs of the Dow”. The strategy entails buying the worst performing stocks in the Dow Jones Industrial …

Continue readingThe Fed is doing their best to orchestrate a soft landing for their rate lift-off. Yeah, that makes no sense. But I made it up myself and it makes me laugh. The FOMC are quick learners …

Continue readingToday we got less than expected easing from the ECB that triggered a massive risk off sell off in Europe, while on this side of the Atlantic the Fed Chair continues to make the case …

Continue readingOver the past month, leading up to this morning’s ECB meeting and the FOMC’s December 16th meeting we have taken a look at the U.S. dollar on a couple of occasions. First vs the Euro (here on …

Continue readingIn front of Friday’s OPEC meeting, S&P Energy Select etf (XLE) puts are active, with 83,000 puts already trading on the day, vs the one month average of 61k per day and 27k calls traded …

Continue readingIn case you missed it, the two year chart of crude oil….. has been the inverse of the two year chart of the DXY, the US dollar index…. Yeah, I know you took your Econ back …

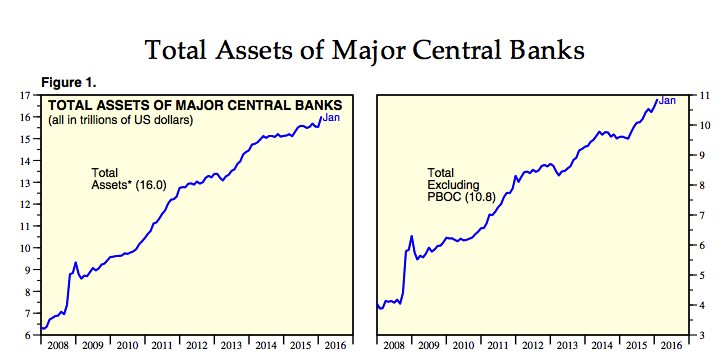

Continue readingSince the start of QE and ZIRP, Don’t fight the Fed has been one of the most profitable consensus US equity trades of the last fifty years. In the last year, the Fed has ended …

Continue reading