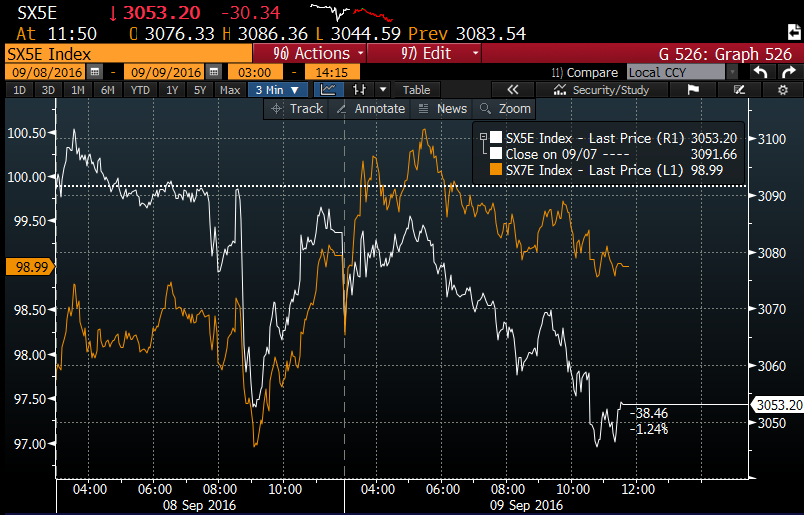

A combination of the ECB not as dovish as some would expect yesterday, and increased expectations for a U.S. Fed rate increase in September have stocks and bonds falling today, while the U.S. dollar and rates …

Continue readingECB

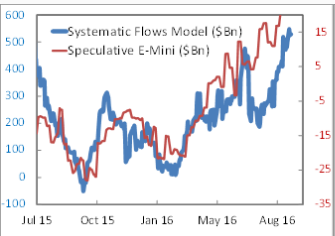

Last night on CNBC’s Fast Money, Marko Kolanovic, JPMorgan’s global head of derivative strategy made the case for an uptick in volatility, and the strong potential for a pullback in U.S. stocks nearing 5% between now …

Continue readingAs most of you know, sentiment is a strange bedfellow when it comes to financial markets. It’s usually dire or running hot at the opposing extreme in the actual market, bottoms or tops. I’ve always felt …

Continue readingWe’ll be fighting in the streets With our children at our feet And the morals that they worship will be gone And the men who spurred us on Sit in judgement of all wrong They …

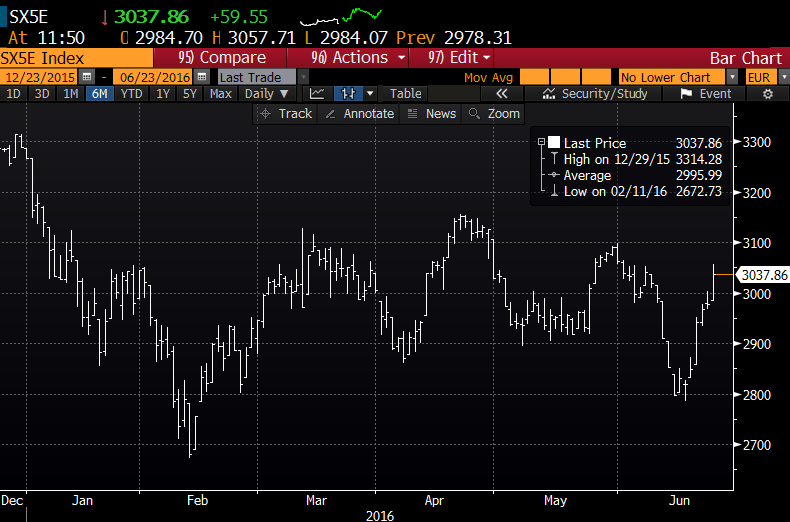

Continue readingIn the lead up to, and the way out of the late June Brexit vote, European banks were thought to be the most vulnerable in the event of a Leave vote. They had already been …

Continue readingNo matter what you think global stocks should do on Brexit referendum results, European stocks have already factored in a higher likelihood of a Remain vote. The rally in the past week has them nearly …

Continue readingBear with me, this is a bit of a think piece, it’s not likely to help you make money, merely some ramblings on what was a fairly confusing last couple days in global financial markets: Earlier …

Continue readingYesterday I highlighted the violent upward reaction in global equities and the Euro following the ECB’s announcement of monetary easing measures. By the end of the day European equities had traded in a 5% range, …

Continue readingI have a feeling that we will look back on today and say this was a fairly important reversal day, maybe not only in risk assets, but possibly in investor sentiment towards the effectiveness of Central …

Continue readingReminder: I’ll be a panelist on the latest Ticker District webinar this evening, at 8pm If you haven’t already register here: Webinar Preview: As we head into a potentially volatile period with three major central …

Continue reading