Investors are scrambling to expand the realm of the sorts of industries, companies, products and services that might fit the narrative of increased infrastructure spending. While tech stocks largely under-performed the initial post election gains …

Continue readingCRM

With the New Year comes no shortage of predictions for financial markets for 2017. My crystal ball is in the shop, but I want to highlight a tech prediction from famed venture capitalist Fred Wilson, founder …

Continue readingShares of enterprise cloud software provider Workday (WDAY) plunged 17.5% on Friday before closing the day down 12.5%. The carnage came after the company’s fiscal Q3 report, punctuated by weak forward guidance. WDAY might be a …

Continue readingWe spend a lot of time discussing corporate quarterly earnings as they represent the potential for unusual volatility around a known event. For a stock market that spends most of its time trading on general …

Continue readingSalesforce.com (CRM) has lost 10% of its market value (about $5 billion) since offering disappointing billings for the current quarter in late August. The stock is down almost 17% from its all time highs made in May, and …

Continue readingOn September 8th we took a look at Salesforce (CRM) and determined that there was a strong possibility that the stock would remain under pressure into their Q3 report in November. The main reason being the weakness in billings was unlikely …

Continue readingAdobe (ADBE) reports tonight after the close. The options market is implying about a 4% one day move tomorrow, which is rich to the 4 qtr average one day post earnings move of 3.5%. The …

Continue readingThere is little doubt that Salesforce.com (CRM) has been a pioneer of one of the largest secular shifts in enterprise computing in decades, and is helmed by a guy who has the potential to be the next …

Continue readingLast night Salesforce.com (CRM) reported fiscal Q2 results that were generally inline. They guided the current quarter down a touch, and left full year guidance intact. The stock was down 8% last night in the …

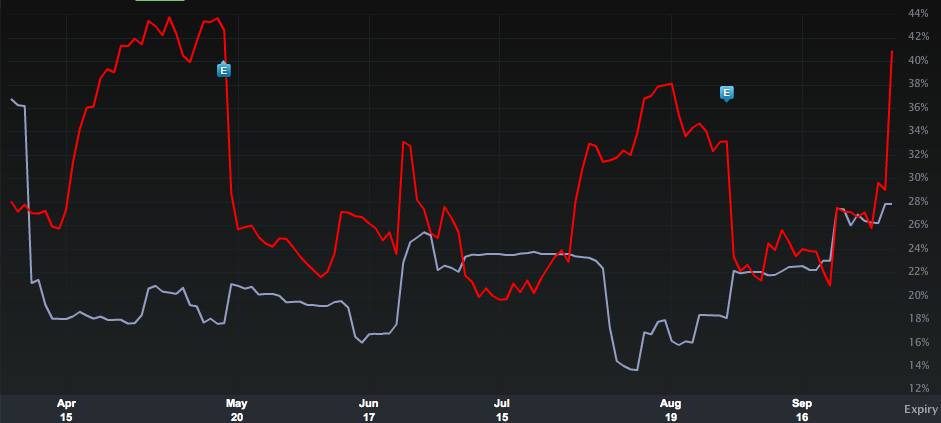

Continue readingEvent: Salesforce.com (CRM) reports fQ2 results tonight after the close. The options market is implying about a 5.5% one day move, which is basically inline with the 4 qtr one day average move of 5.3%, …

Continue reading