To state the obvious, positive returns in U.S. equity markets were hard to come by unless you were invested in a couple dozen large cap growth stocks. And from a trading perspective it was a fool’s …

Continue readingConsumer Discretionary

Event: Tomorrow before the open The Home Depot (HD) will report Q2 results. The options market is implying a 3.3% one day move, which is in line with the 4 qtr avg move. With the …

Continue readingTo state the obvious, the price action yesterday in media stocks was atrocious, with both Disney (DIS) and Time Warner (TWX) closing down about 9%. What’s troubling about a one day moves of that magnitude …

Continue readingWith close to 85% of the S&P 500 components having reported calendar Q1 earnings so far, I think it is safe to say results were a mixed bag. While the official beat/miss statistics may paint …

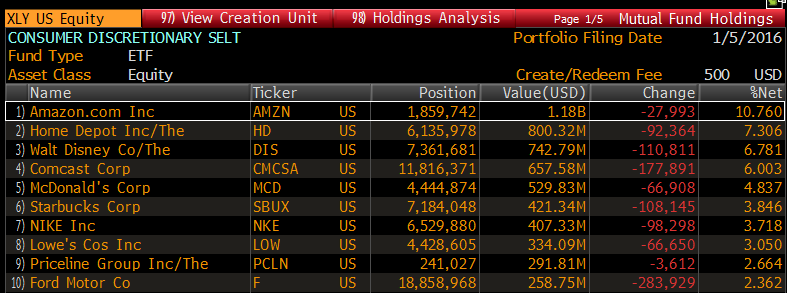

Continue readingOn Friday after noon we outlined a trade idea in the Consumer Discretionary etf, XLY. The idea was not to press the weakness, but wait for a bounce and then enter the trade. With equities …

Continue readingYesterday I noted how odd it is at this stage of the economic recovery here in the U.S. that markets still cheer bad economic data (the idea being it pushes potential rate hikes further [read …

Continue readingI think it is safe to say that the Federal Reserve’s policy of zero interest rates was largely intended to stimulate economic activity. However, another consequence for corporate America was the potential for massive financial engineering …

Continue readingRetail’s weakness to start 2014 has been greeted by the broader market with a fair bit of complacency. Investors have shrugged off one negative sales report after another with the view that the problems are …

Continue readingI discussed the frequent irrationality of stock valuations in my CotD post yesterday. However, so far in 2013, market players are acting a bit more rational about sector allocations, at least based on current valuations. …

Continue reading