Event: Nike (NKE) reports fiscal Q2 results tonight after the close. The options market is implying about a 4.5% one day post earnings move. With the stock at $51.50, the Dec23rd weekly 51.50 strangle (the call …

Continue readingCarter Worth

Earlier Josh Brown blogged and tweeted about the S&P Metals and Mining (XME) ratio chart to the S&P 500 (SPX), saying: Ten years of underperformance. A long-term downtrend now being snapped, the year to date …

Continue readingRegular readers know that most of our trade/ investment ideas start with something fundamental, usually some sort of catalyst, or relative valuation etc, but we also like to use as many inputs as possible to help formulate …

Continue readingEvent: Verizon (VZ) reports Q3 results tomorrow before the open. The options market is implying a 2% one day post earnings move, which is essentially in line with the 4 quarter average. Price Action / …

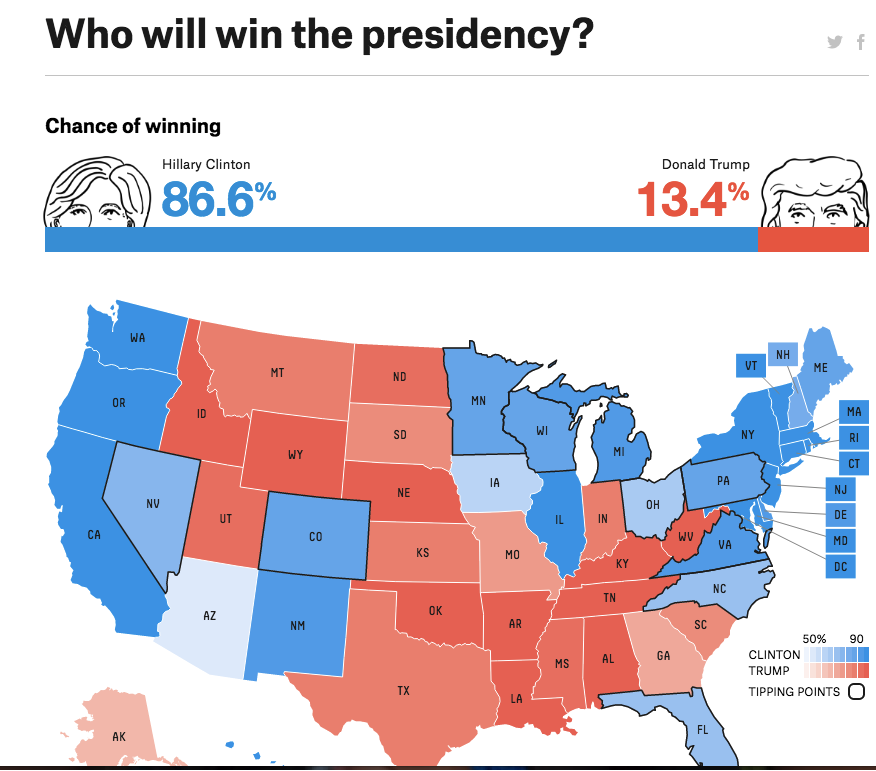

Continue readingIt’s been my view for some time that on top of the very large list of risks to a fragile U.S. economic recovery (and increasingly vulnerable global financial markets) is the election of Donald Trump to be …

Continue readingOn CNBC’s Fast Money last night, Carter Worth, Cornerstone Research’s star technician made the case for continued gains in large cap tech: When asked which sector looked the best on the charts Carter highlighted semiconductor …

Continue readingEvent: Tesla (TSLA) reports Q2 results tonight after the close. The options market is implying about a 7% one day post earnings move, which is just shy of its 4 qtr average one day post …

Continue readingWe’ll be fighting in the streets With our children at our feet And the morals that they worship will be gone And the men who spurred us on Sit in judgement of all wrong They …

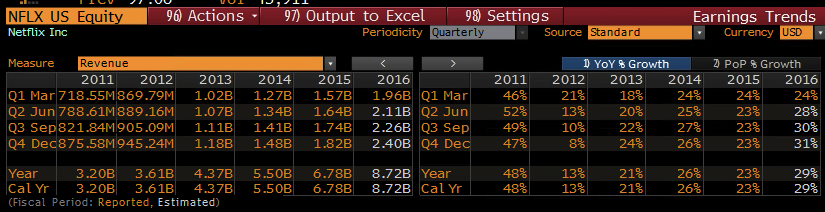

Continue readingOver the weekend, Barron’s made the case why Netflix Could Fall 40% or More as the Stock’s Sizzle Slows. Nothing particularly new here, valuation, slowing growth & competition are the main reasons why the stock “Could …

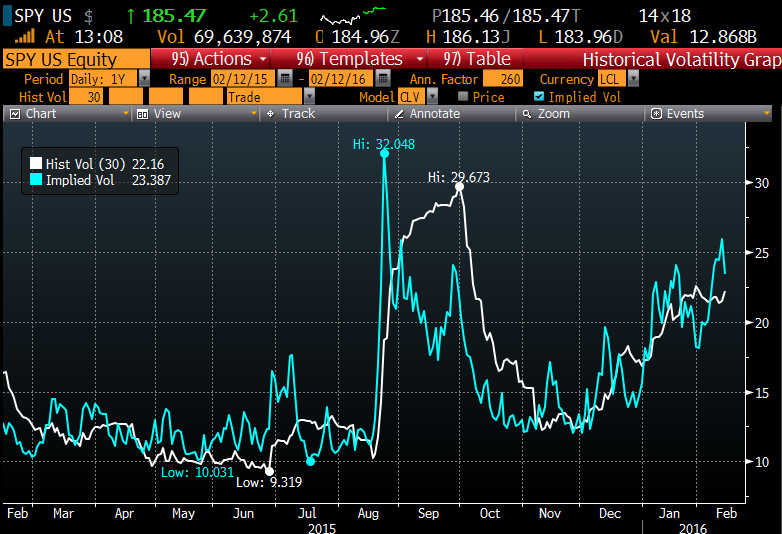

Continue reading6Last night on CNBC’s Fast Money my friend Carter Worth of Cornerstone Macro Research laid out his technical view on the S&P 500 (SPX). He has been consistent for months, if not quarters that the …

Continue reading