Amazon (AMZN) reports Q2 earnings tonight after the close. The options market is implying about a $100 move in either direction tomorrow, or about 5.4%.

AMZN yesterday traded at a new all time high, down 2% today on the Facebook (FB) disappointment, but the stock is up a whopping 55.5% year to date, in a dead heat with Alphabet (GOOGL) for the number two market cap spot behind Apple (AAPL).

To my eye, AMZN’s recent gains are pretty steep, not to dissimilar to FB into its print. Bu the uptrend from the early April lows has been a bit of a stair-step with near term support at last weeks lows near $1760 and then massive support just above 1600 near the early June breakout level. Yeah and there is no overhead resistance.

The stock is obviously priced for perfection with expectations unusually high into the print. Much like FB, Wall Street analysts are overwhelmingly positive with 48 Buy ratings, 3 Holds and NO Sells.

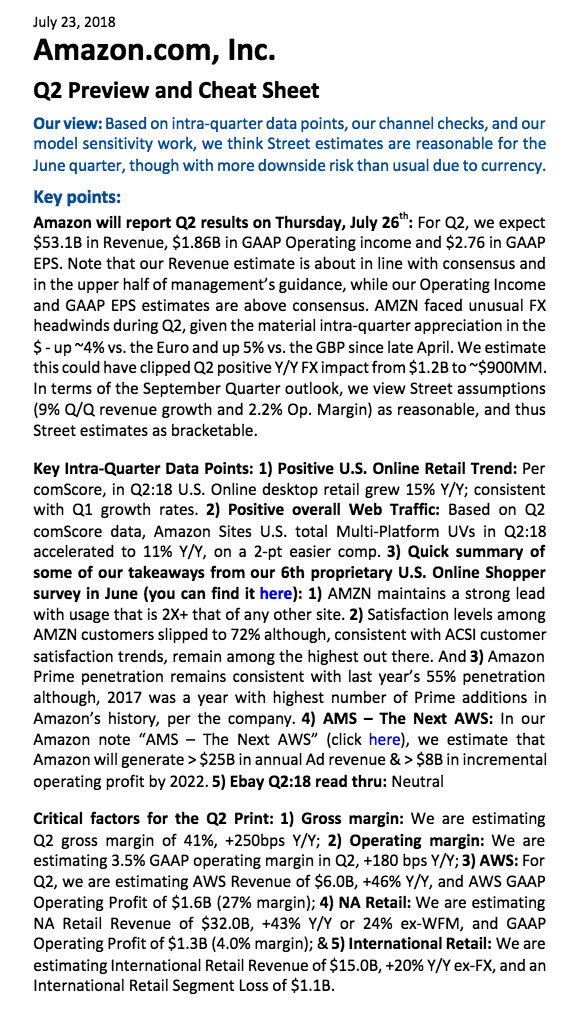

One of the most staunch bulls, for years on AMZN has been RBC’s Mark Mahaney who rates the stock a buy with a $1900 price target highlights the following factors to focus on into the print:

So what’s the trade?

As I said in front of FB, I would not buy the stock at highs into a potentially volatile print, but it is important to note that for those with a convicted directional view that if you take the implied move, which is figured by taking the weekly at the money straddle (the call premium + the put premium), then if you were to just buy the at the money call if you were bullish, or buy the at the money put because you were bearish, then you only need half the implied move. For instance with the stock around $1820 the July 27th weekly put and call are each about $50, or about 2,7%. That is what you would be risking to make a near the money. You could further reduce the premium at risk and increase the probability of success.

But I did get a question from a friend who recently told me that in the last couple months has added significantly added to his AMZN position asking what I thought. He has owned his core position for a very long time and obviously has large gains. So regular readers probably know where I am going with this… how could you feel comfortable staying long, while defining your risk, while also having potential upside gains out of the print tomorrow? Using options you can what we call collaring your stock…. for instance,

VS 100 Shares of AMZN long at $1820 you could buy the July 27th weekly (tomorrow) 1880 / 1765 collar for even money

-Sell to open 1 1880 call at $24

-Buy to open 1 1765 put for $24

Break-even on Tomorrow’s close:

Profits of the stock of up to 60 between 1820 and 1880. Above 1880 the stock is either called away, up 3.3%, or you could cover the short call to keep the long stock position intact.

Losses of the stock of up to $55 between 1820 and 1765 but protected below 1765, down about 3%.

Rationale: one would only do this overlay to a long stock position if they were more concerned about greater downside potential than upside potential and clear about the trade management if the stock is at or above the short call strike. This is a very reasonable hedge given the extreme volatility in FB shares today.